How to Trade Crypto in AscendEX

How to Start Cash Trading on AscendEX【PC】

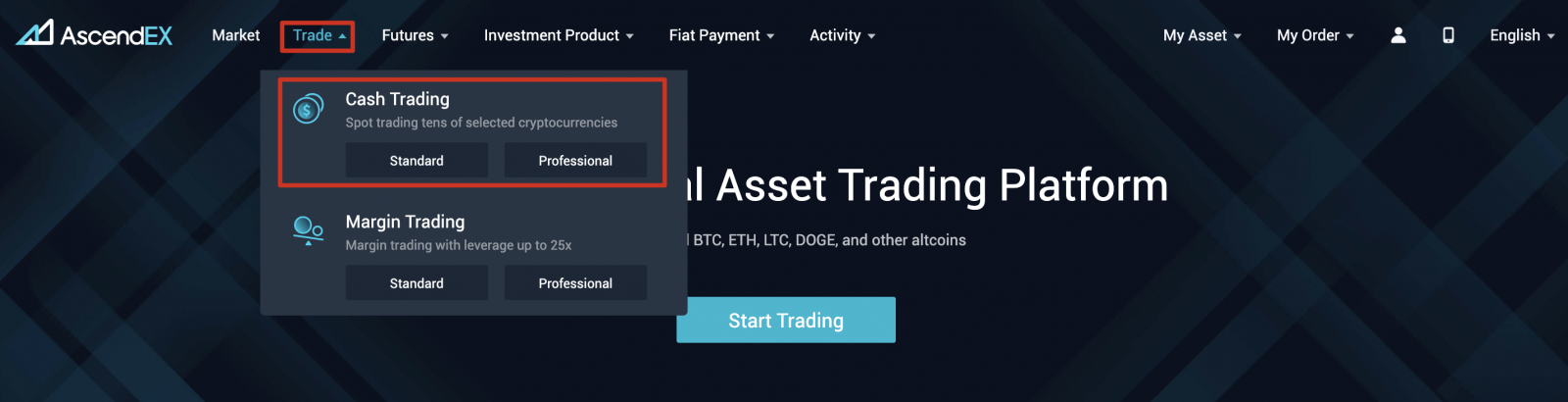

1. First, visit ascendex.com, click on [Trading] –[Cash Trading] at the top left corner. Take [Standard] view as an example.

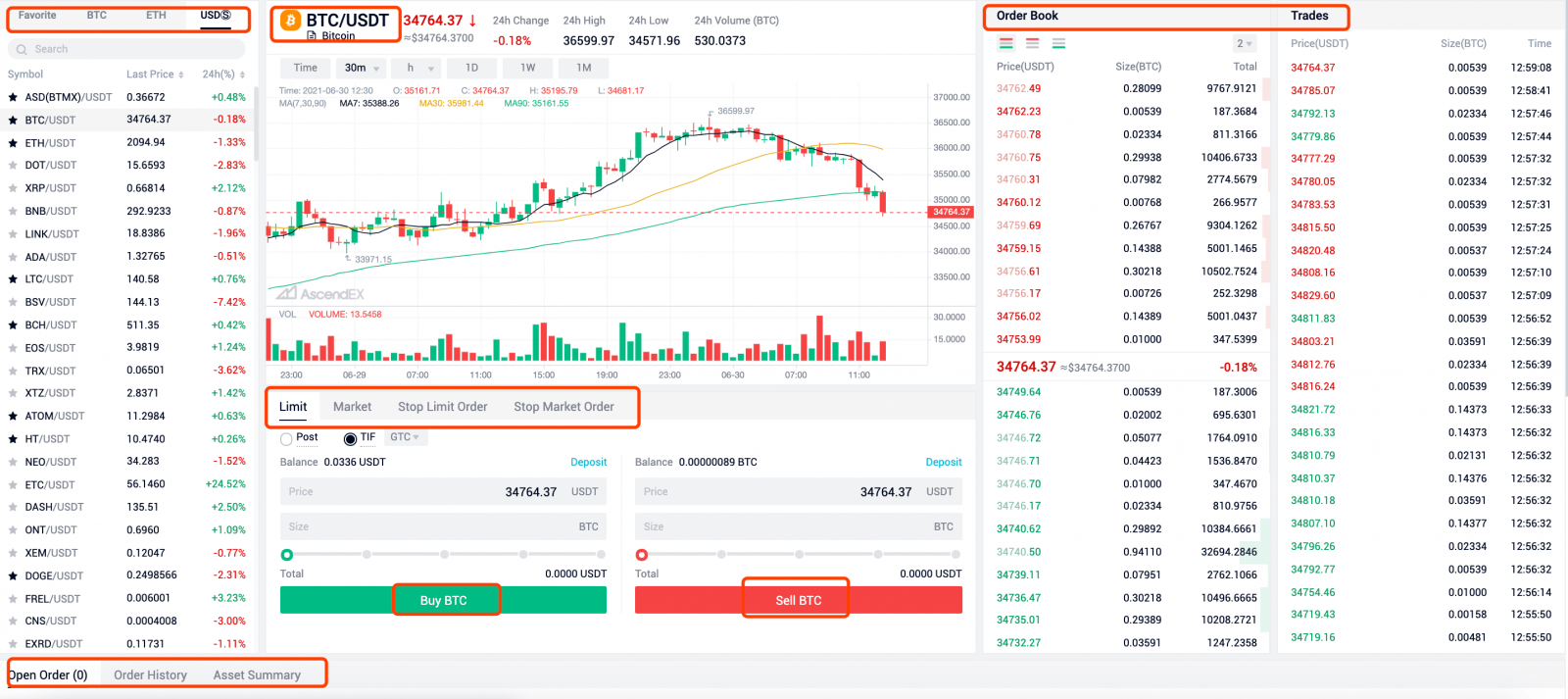

2. Click on [Standard] to enter the trading page. On the page, you can:

- Search and select a trading pair you want to trade on the left side

- Place buy/sell order and select an order type in the middle section

- View candlestick chart in the upper middle area; check order book, latest trades on the right side. Open order, order history and asset summary are available at the bottom of the page

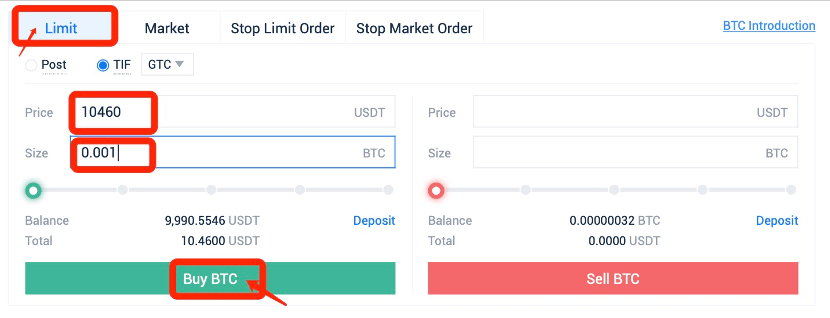

3. Take limit/market order type as an example to see how to place an order:

- A limit order is an order to buy or sell at a specific price or better

- A market order is an order to buy or sell immediately at the best available price on the market

- Click on [Limit], enter a price and size

- Click on [Buy BTC] and wait for the order to be filled at the price you entered

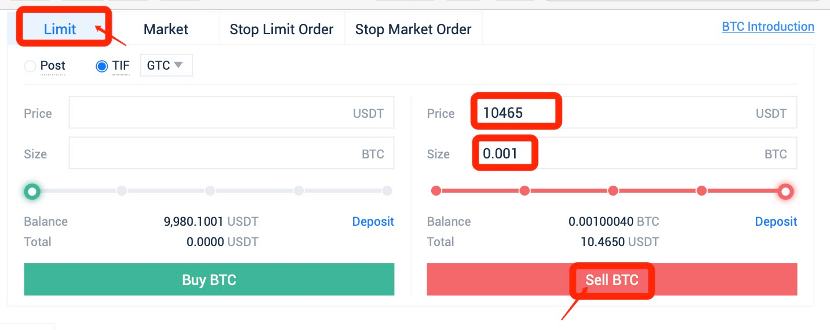

5. After the buy order is filled, you can choose to place a limit order to sell:

- Enter a price and size

- Click on [Sell BTC] and wait for the order to be filled at the price you entered

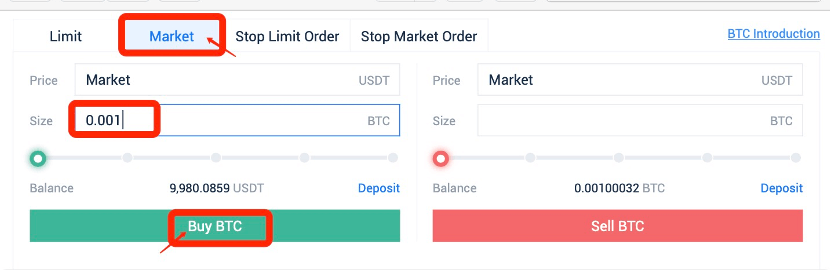

6. If you want to place a market order to buy BTC:

- Click on [Market], and enter an order size

- Click on [Buy BTC] and the order will be filled immediately at the best available price on the market

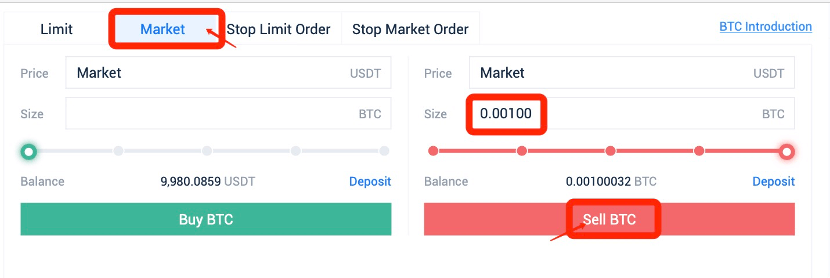

7. If you want to place a market order to sell BTC:

- Click on [Market] and enter an order size

- Click on [Sell BTC] and the order will be filled immediately at the best available price on the market

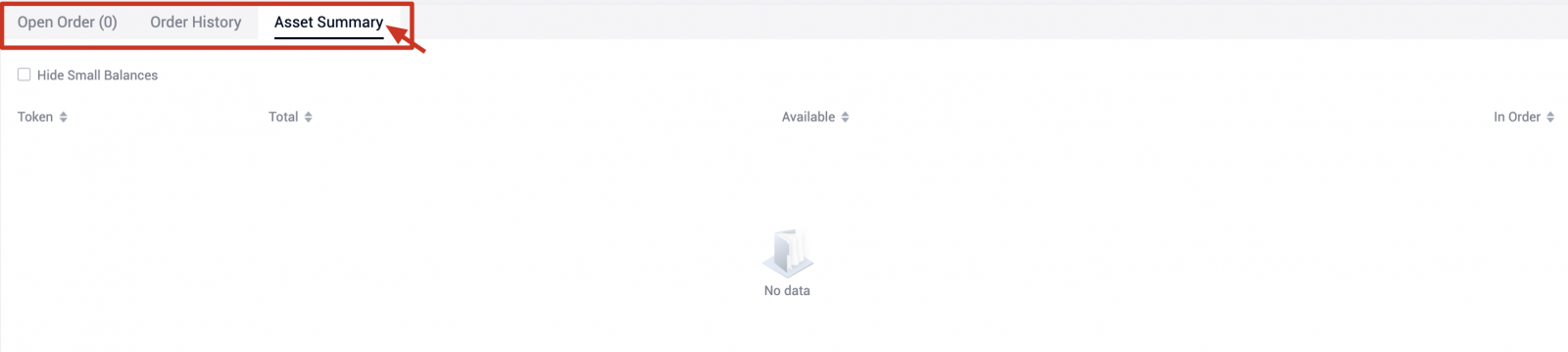

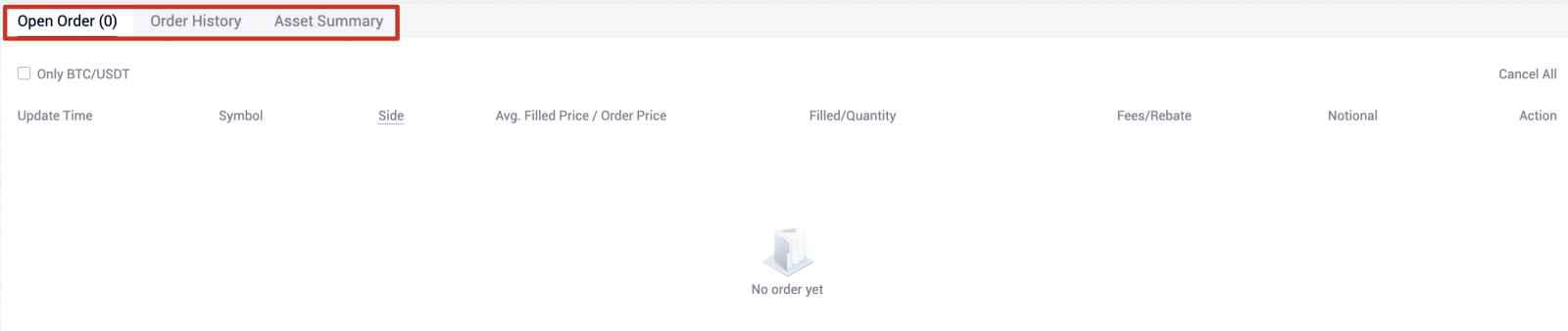

8. Order details can be viewed at the bottom of the trading page.

Notes:

When the order is filled and you are worried that the market might move against your trade. you can always set a stop loss order to limit potential losses. For further details, please refer to How to Stop Loss in Cash Trading.

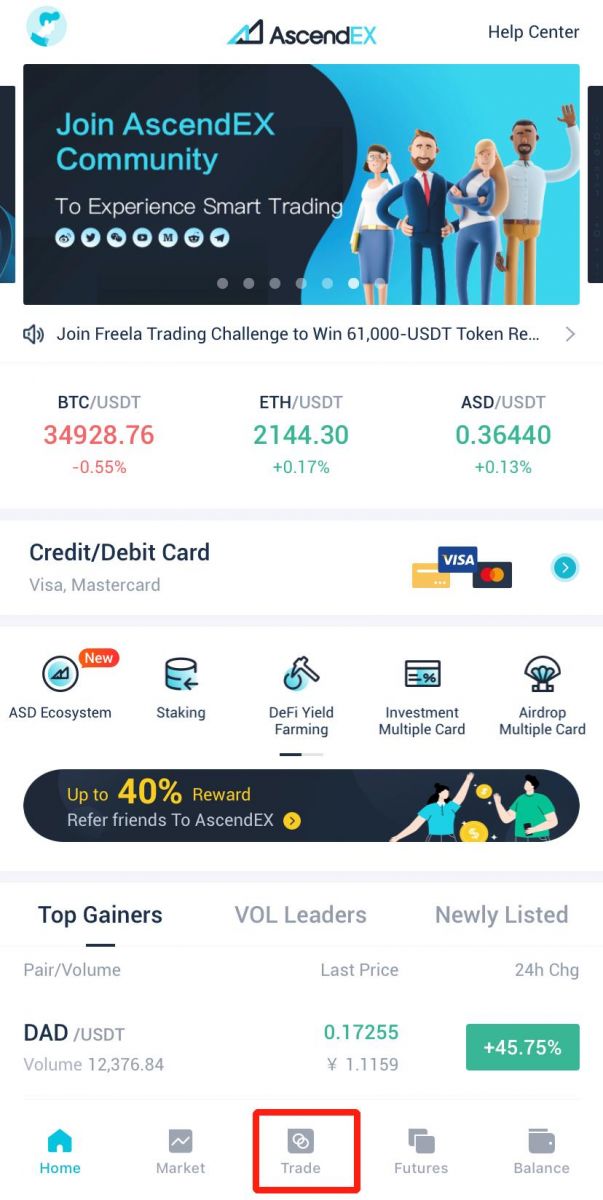

How to Start Cash Trading on AscendEX【APP】

1. Open AscendEX App, visit [Homepage] and click on [Trade].

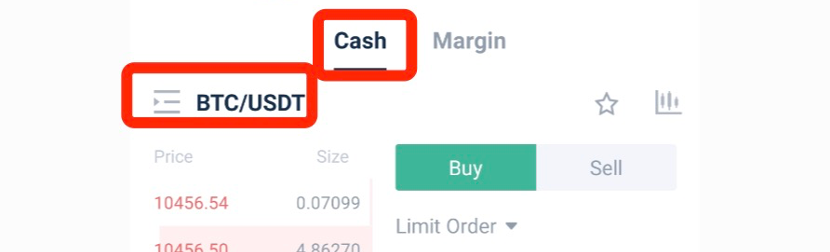

2. Click on [Cash] to visit cash trading page.

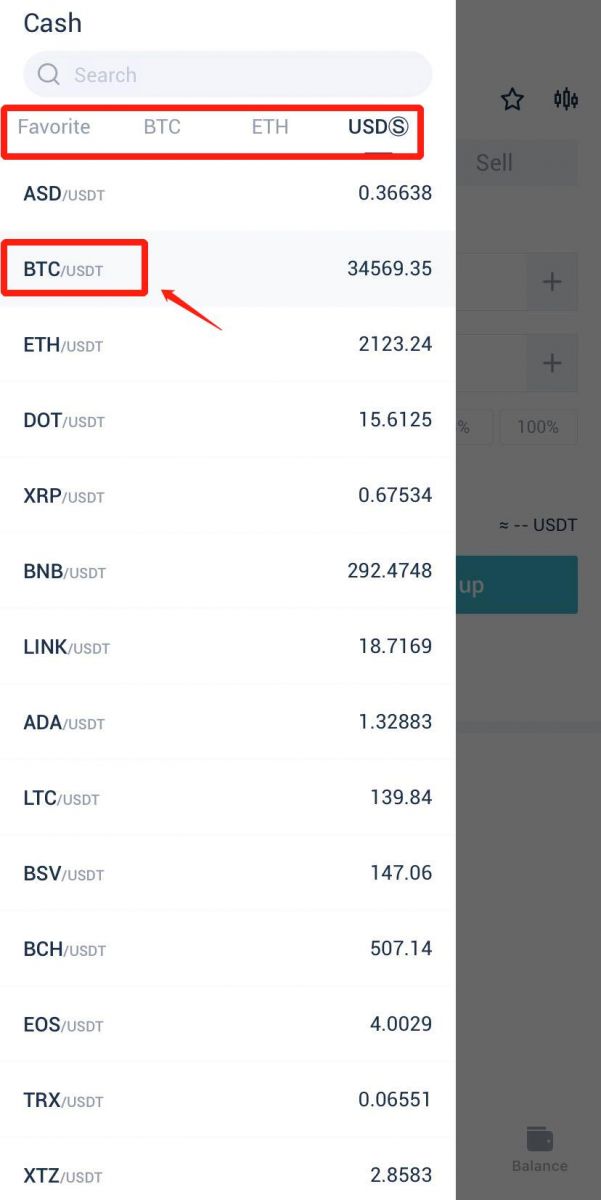

3. Search and select a trading pair, select an order type and then place a buy/sell order.

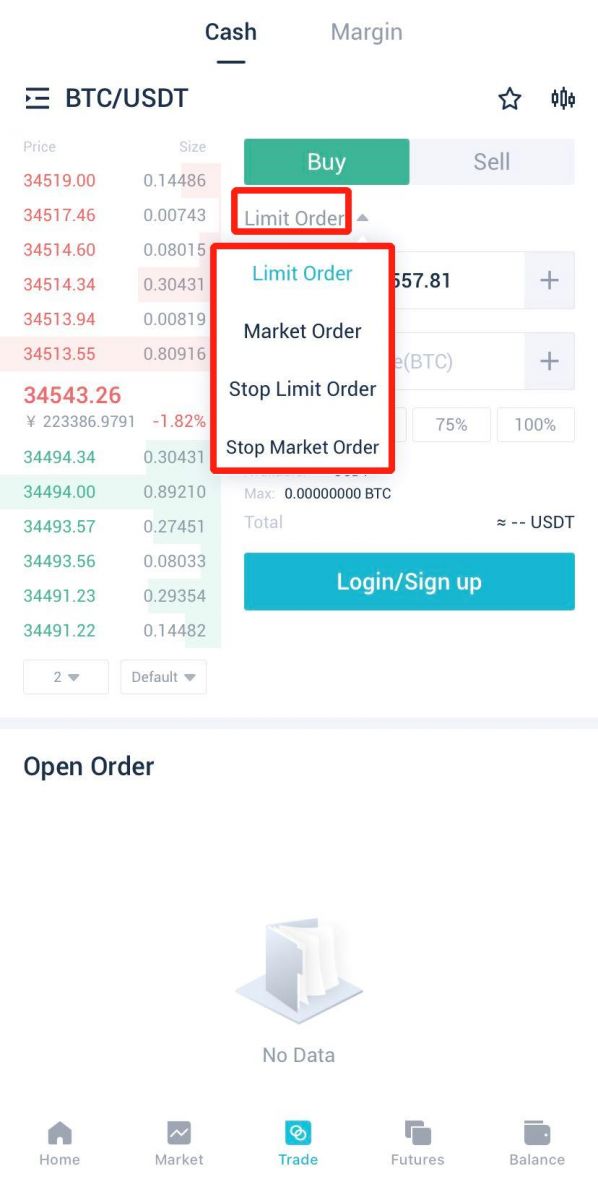

4. Take limit/market order as an example to see how to place an order:

A. A limit order is an order to buy or sell at a specific price or better

B. A market order is an order to buy or sell immediately at the best available price on the market

B. A market order is an order to buy or sell immediately at the best available price on the market

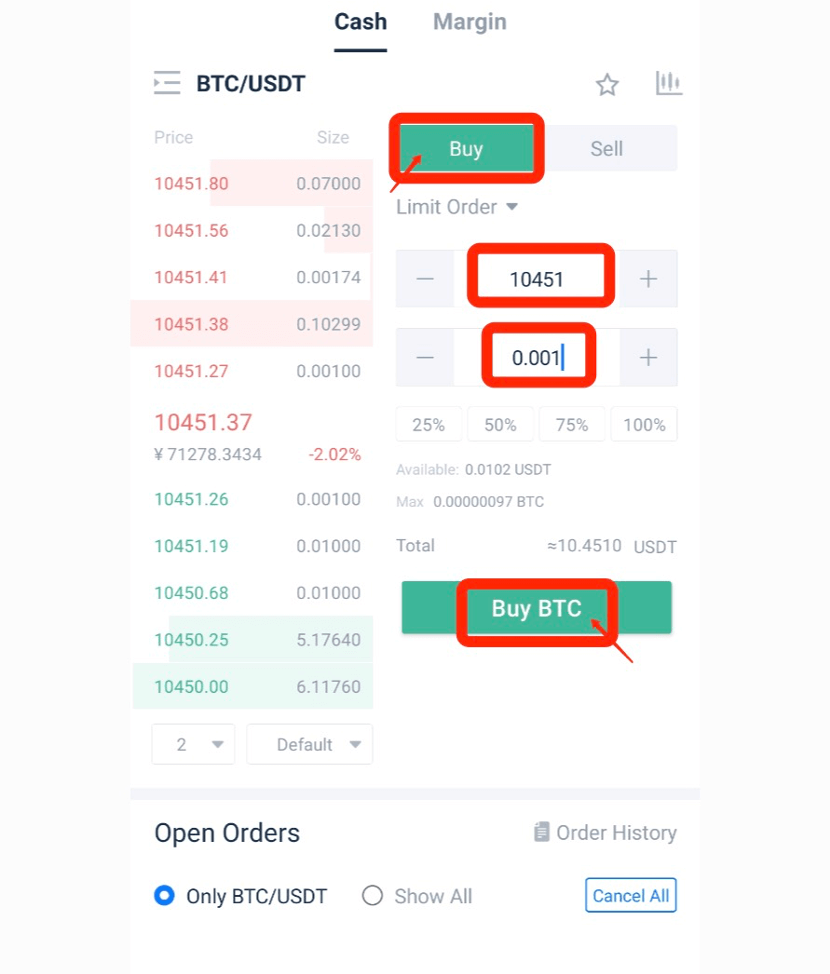

5. Let’s say you want to place a limit order to buy BTC:

A. Select [Limit Order]

B. Enter an order price and size

C. Click on [Buy BTC] and wait for the order to be filled at the price you entered

B. Enter an order price and size

C. Click on [Buy BTC] and wait for the order to be filled at the price you entered

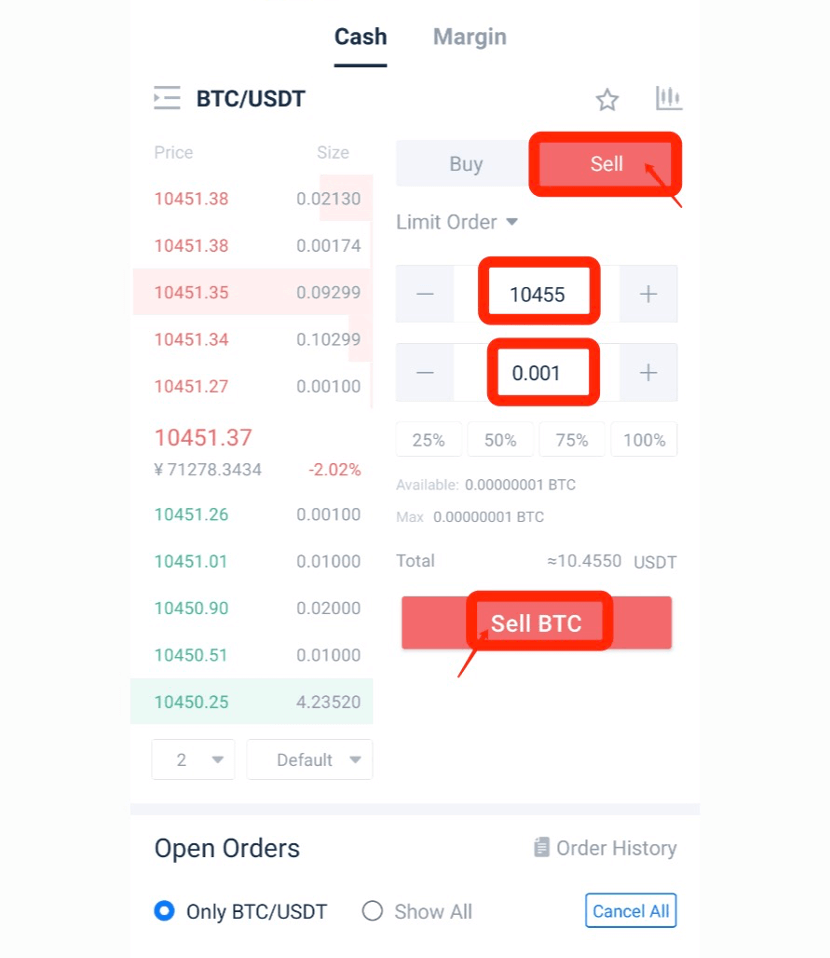

6. After the buy order is filled, you can choose to place a limit order to sell:

A. Select [Limit Order]

B. Enter an order price and size

C. Click on [Sell BTC] and wait for the order to be filled at the price you entered

B. Enter an order price and size

C. Click on [Sell BTC] and wait for the order to be filled at the price you entered

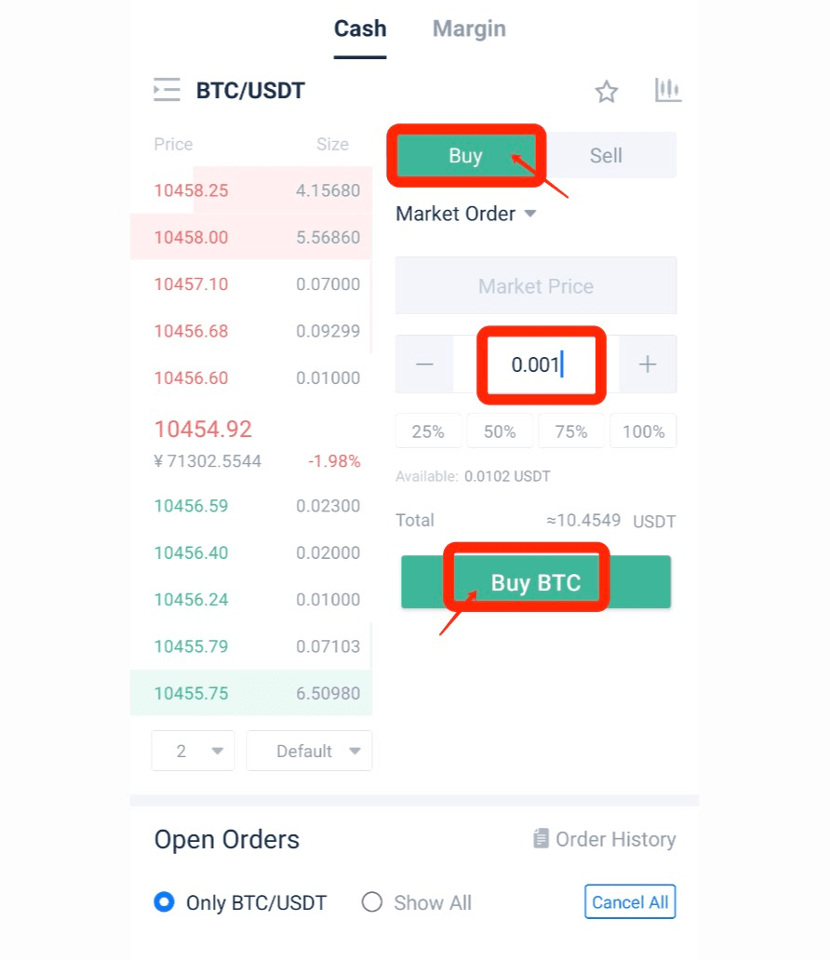

7. If you want to place a market order to buy BTC:

A. Select [Market Order], and enter an order size

B. Click on [Buy BTC] and the order will be filled immediately at the best available price on the market

B. Click on [Buy BTC] and the order will be filled immediately at the best available price on the market

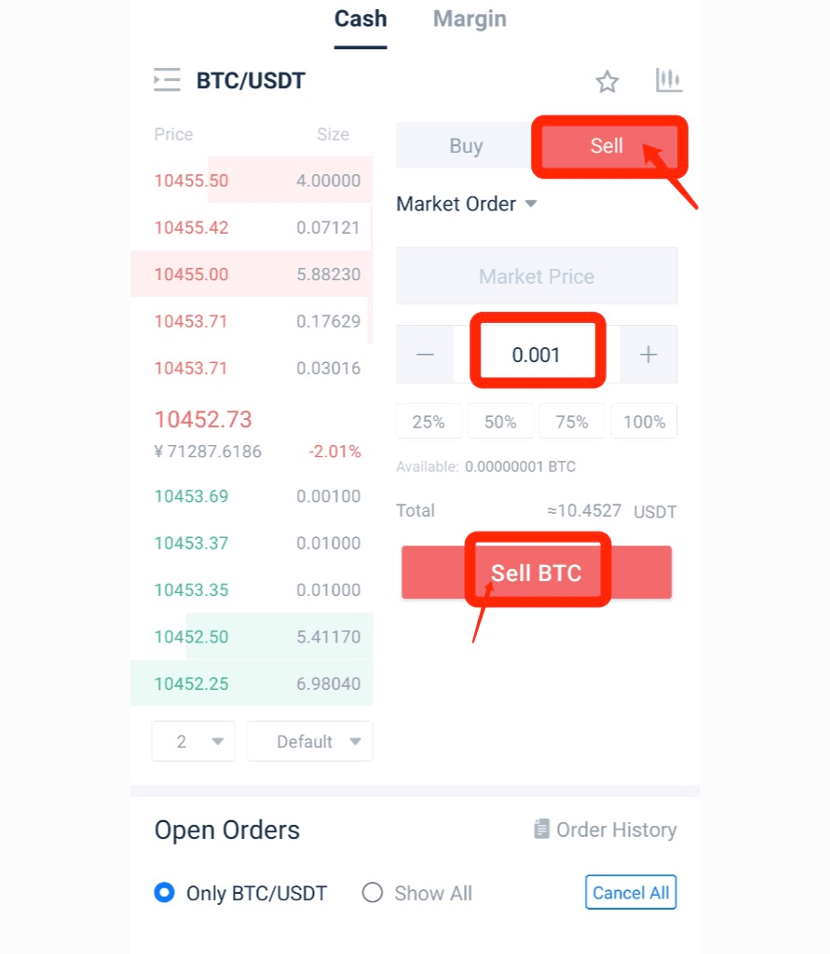

8. If you want to place a market order to sell BTC:

A. Select [Market Order] and enter an order size

B. Click on [Sell BTC] and the order will be filled immediately at the best available price on the market

B. Click on [Sell BTC] and the order will be filled immediately at the best available price on the market

9. Order details can be viewed at the bottom of the trading page.

Notes:

When the order is filled and you are worried that the market might move against your trade, you can always set a stop loss order to limit potential losses. For further details, please refer to How to Stop Loss in Cash Trading [App].

How to Stop Loss in Cash Trading【PC】

1. A stop-loss order is a buy/sell order placed to limit potential losses when you are worried that the market might move against your trade.There are two types of stop-loss orders on AscendEX: stop limit and stop market.

2. For example, your limit buy order of BTC has been filled. If you are worried that the market might move against your trade, you can set a stop limit order to sell BTC.

A. Enter a stop price, an order price and a size

B. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

B. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

3. Assume your limit sell order of BTC has been filled. If you are worried that the market might move against your trade, you can set a stop limit order to buy BTC.

4. Click on [Stop Limit Order]:

A. Enter a stop price, an order price and a size

B. Stop price should be higher than the previous sell price and current price; order price should be ≥ stop price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

5. Assume your market buy order of BTC has been filled. If you are worried that the market might move against your trade, then you can set a stop market order to sell BTC.

6. Click on [Stop Market Order]:

A. Enter a stop price and an order size

B. Stop price should be lower than the previous buy price and current price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

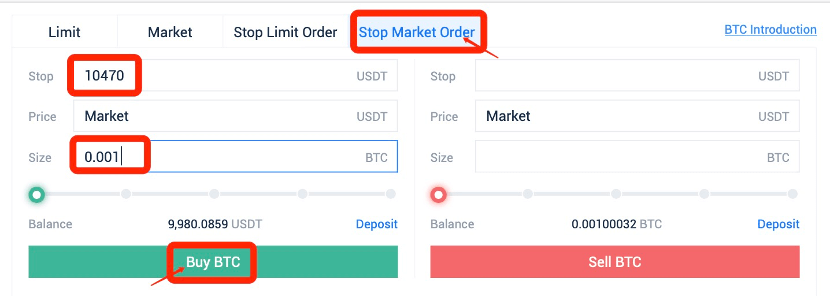

7. Assume your market sell order of BTC has been filled. If you are worried that the market might move against your trade, then you can set a stop market order to buy BTC.

8. Click on [Stop Market Order]:

A. Enter a stop price, an order price and a size

B. Stop price should be higher than the previous sell price and current price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

B. Stop price should be higher than the previous sell price and current price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

Notes:

You have already set a stop loss order to mitigate the risk of potential losses. However, you want to buy/sell the token before the pre-set stop price is reached, you can always cancel the stop order and buy/sell directly.

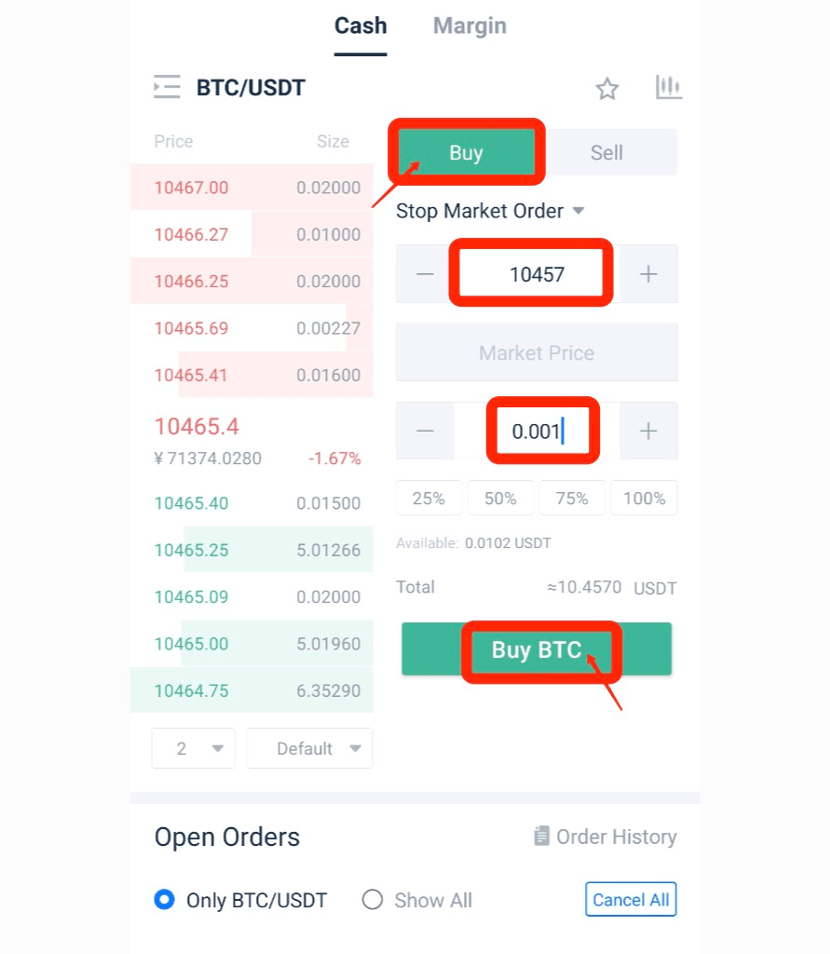

How to Stop Loss in Cash Trading【APP】

1. A stop-loss order is a buy/sell order placed to limit potential losses when you are worried that the prices may move against your trade.There are two types of stop-loss orders on AscendEX: stop limit and stop market.

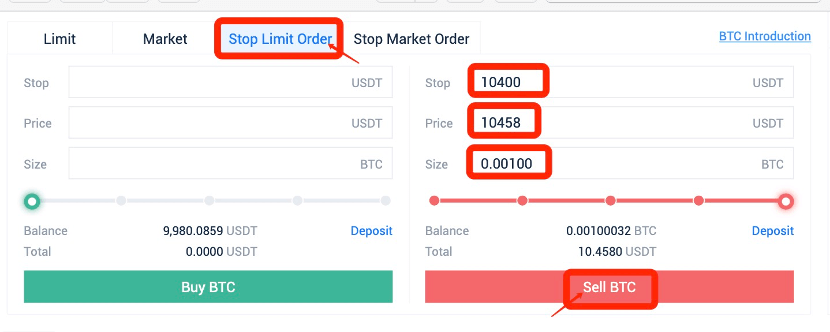

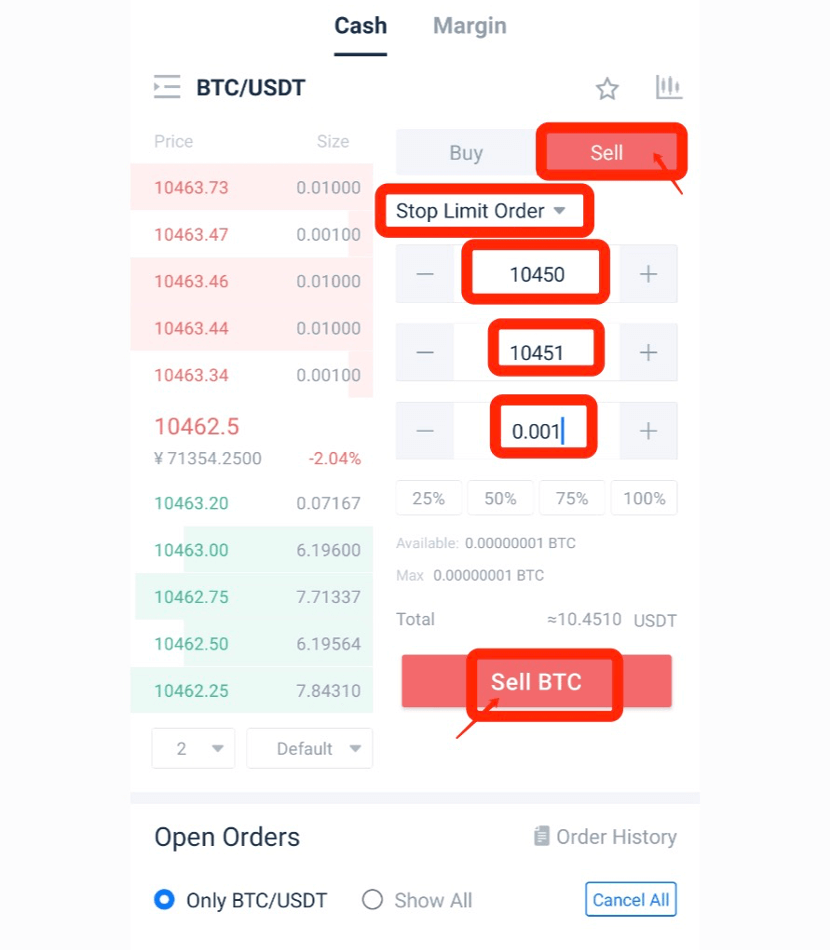

2. For example, your limit buy order of BTC has been filled. If you are worried that the market might move against your trade, you can set a stop limit order to sell BTC.

A. Select [Stop Limit Order]; enter a stop price, an order price and a size

B. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

B. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

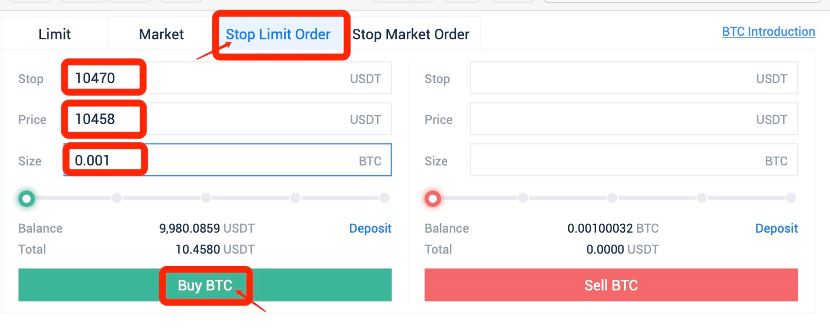

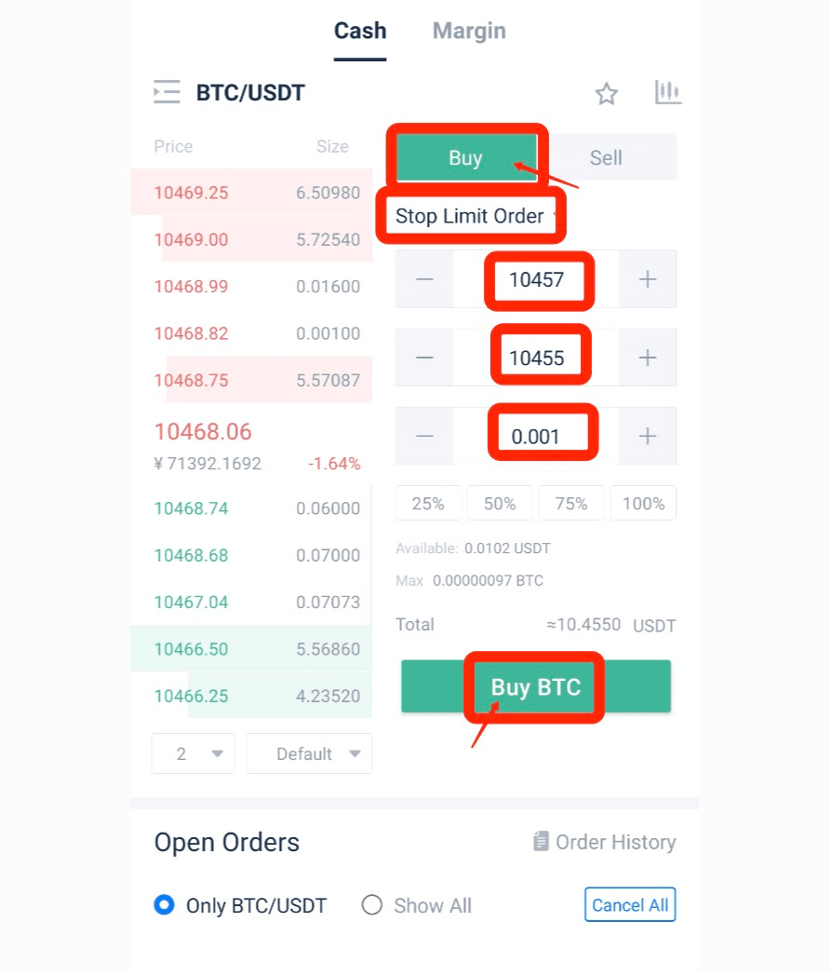

3. Assume your limit sell order of BTC has been filled. If you are worried that the market might move against your trade, you can set a stop limit order to buy BTC.

4. Select [Stop Limit Order]:

A. Enter a stop price, an order price and a size

B. Stop price should be higher than the previous sell price and current price; order price should be ≥ stop price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

B. Stop price should be higher than the previous sell price and current price; order price should be ≥ stop price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order price and size

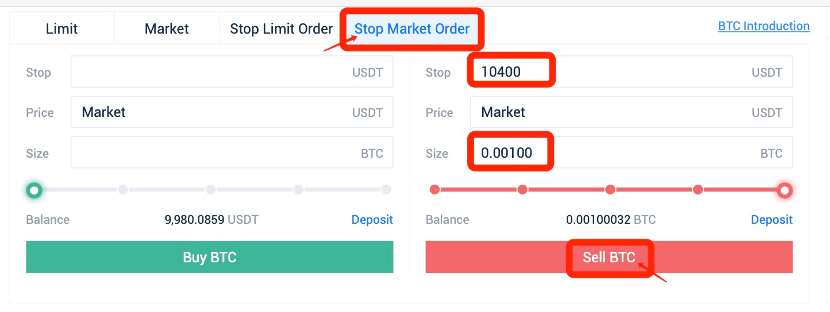

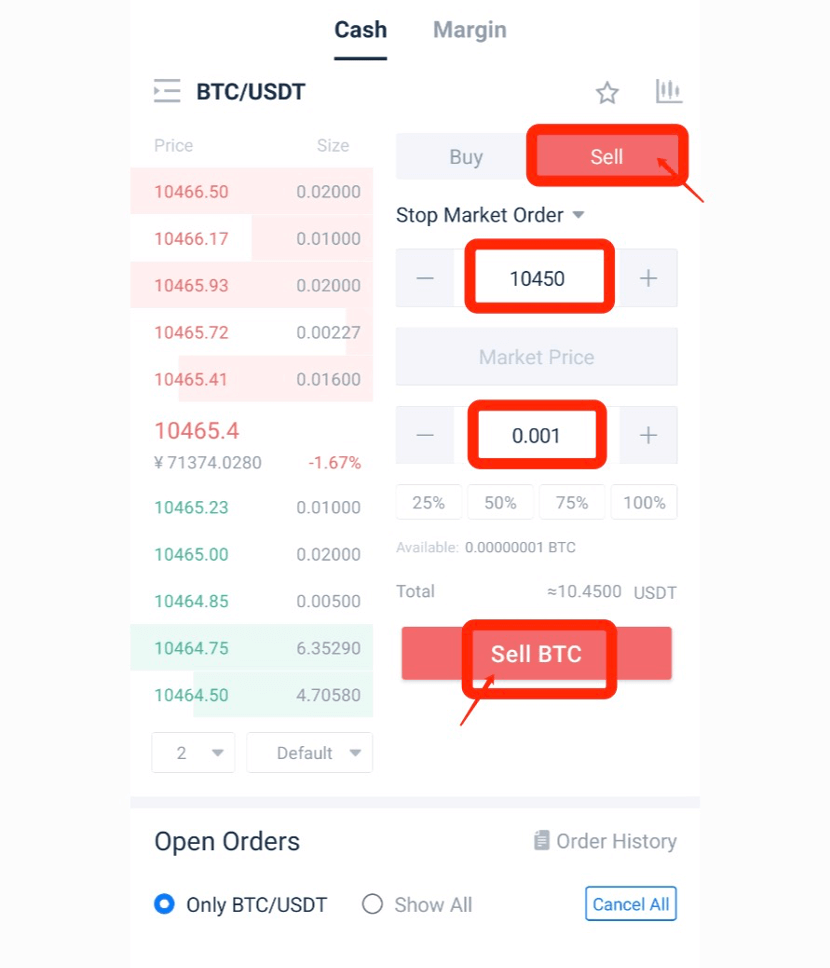

5. Assume your market buy order of BTC has been filled. If you are worried that the market might move against your trade, then you can set a stop market order to sell BTC.

6. Select [Stop Market Order]:

A. Enter a stop price and an order size

B. Stop price should be lower than the previous buy price and current price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

B. Stop price should be lower than the previous buy price and current price

C. Click on [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

7. Assume your market sell order of BTC has been filled. If you are worried that the market might move against your trade, then you can set a stop market order to buy BTC.

8. Select [Stop Market Order]:

A. Enter a stop price and an order size

B. Stop price should be higher than the previous sell price and current price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

B. Stop price should be higher than the previous sell price and current price

C. Click on [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order per the pre-set order size at market price

Notes:

You have already set a stop loss order to mitigate the risk of potential losses. However, you want to buy/sell the token before the pre-set stop price is reached, you can always cancel the stop order and buy/sell directly.

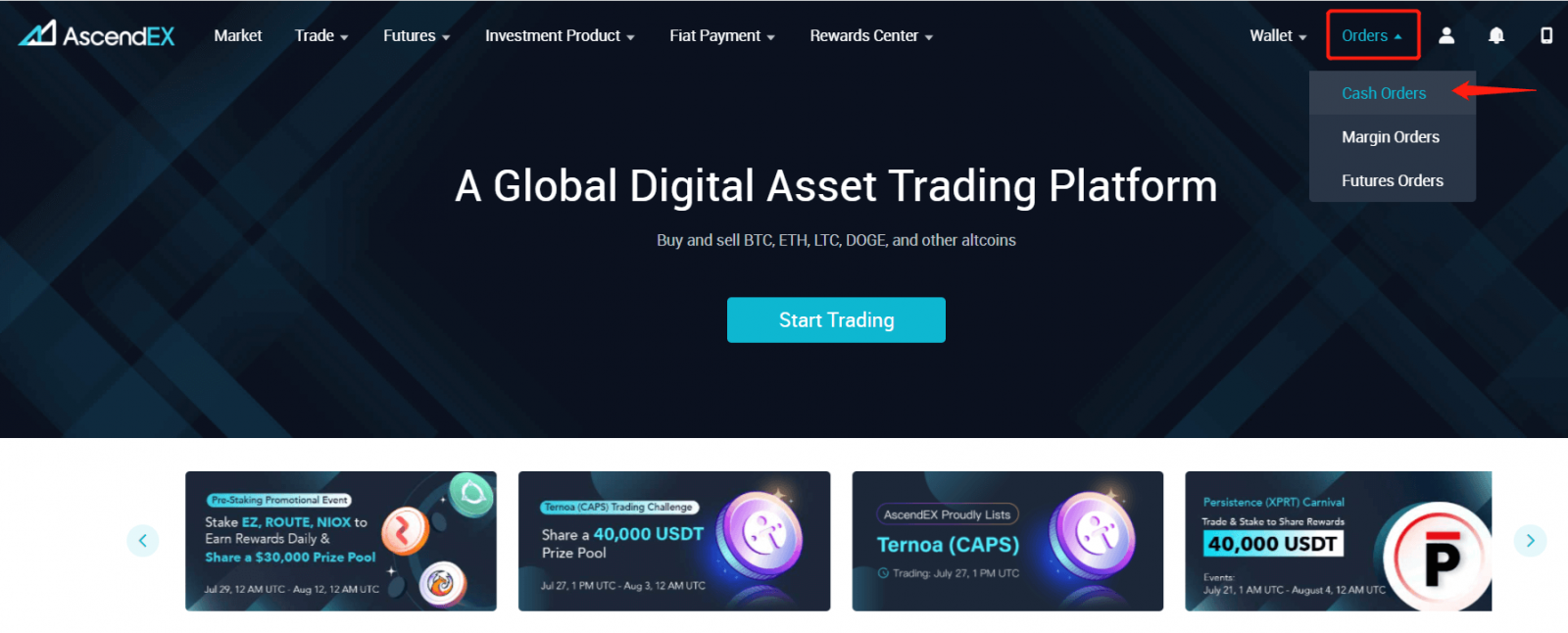

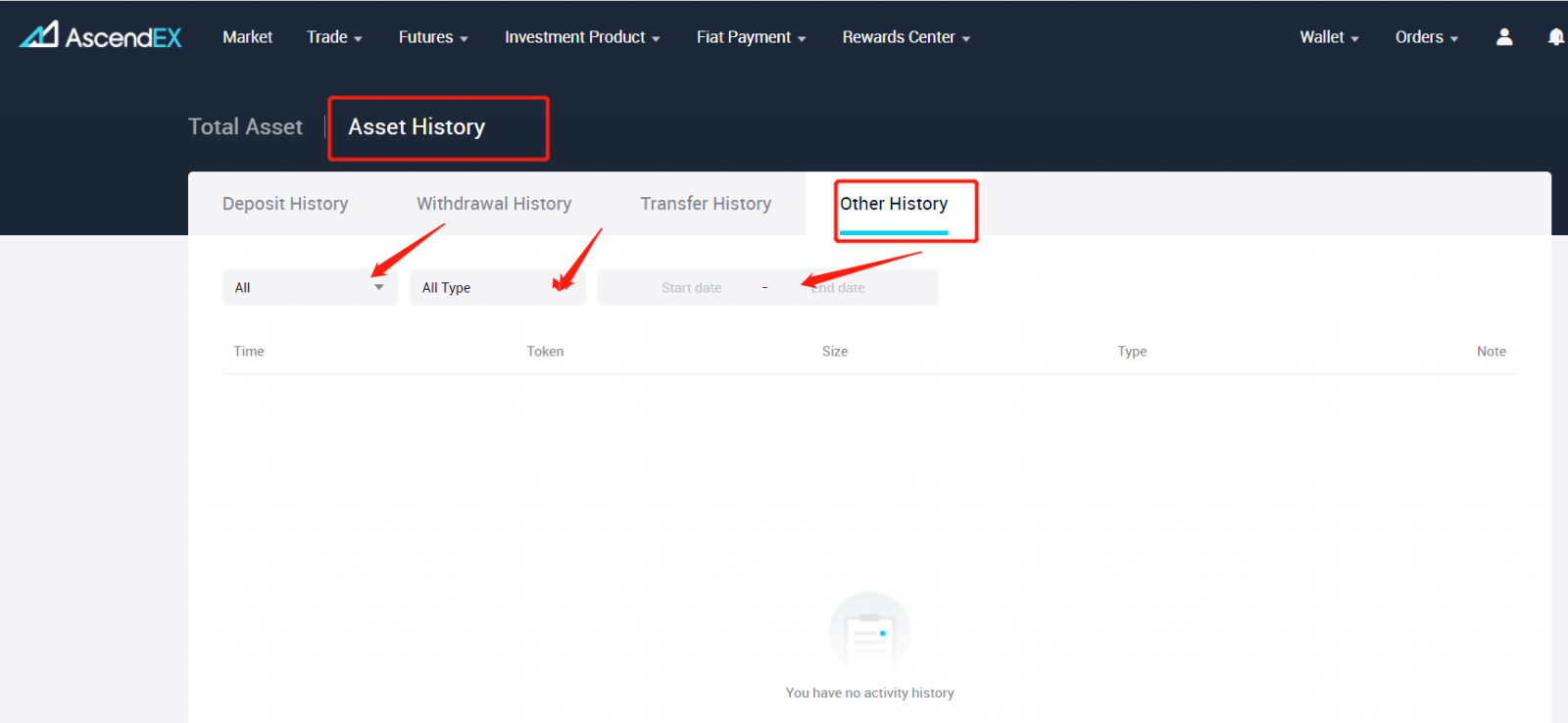

How to Check for Order History and Other Transfer History【PC】

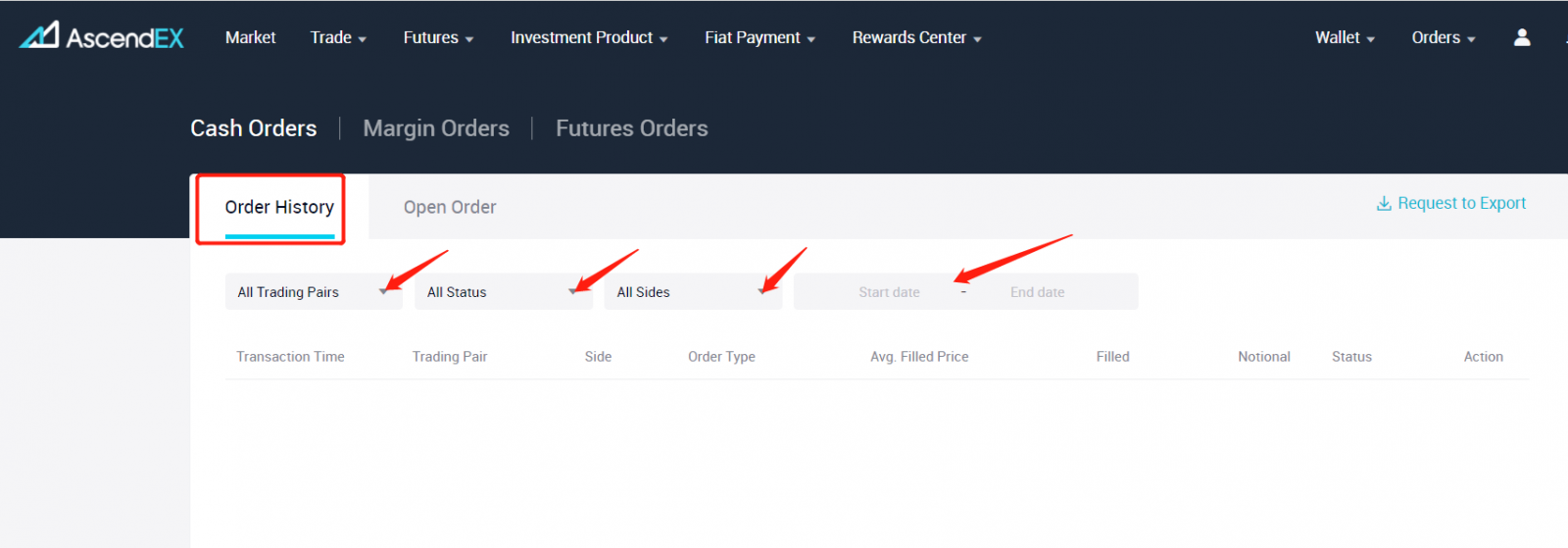

Check for Order History1. Take cash orders for example: Users should visit AscendEX’s official website on their PC. Click [Orders] on the homepage – [Cash Orders].

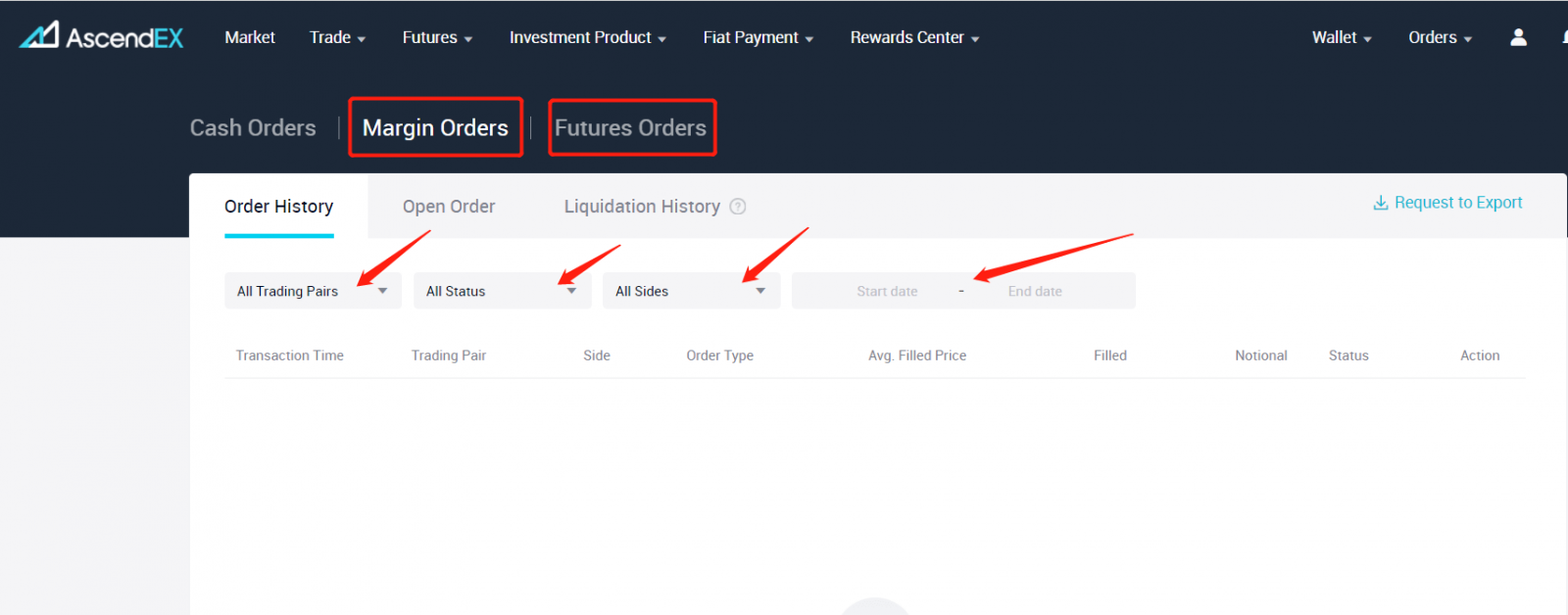

2. Under the Order History tab on the Cash Orders page, users can check for the following information: trading pairs, order status, order sides and date.

3. Users can check the margin/futures orders history on the same page.

Check for Other Transfer History

1. Click [Wallet] on the homepage on AscendEXs website – [Asset History].

2. Click the Other History tab on the Asset History page to check for the following information: tokens, transfer types and date.

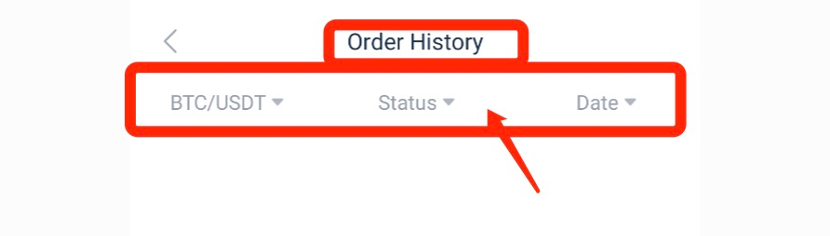

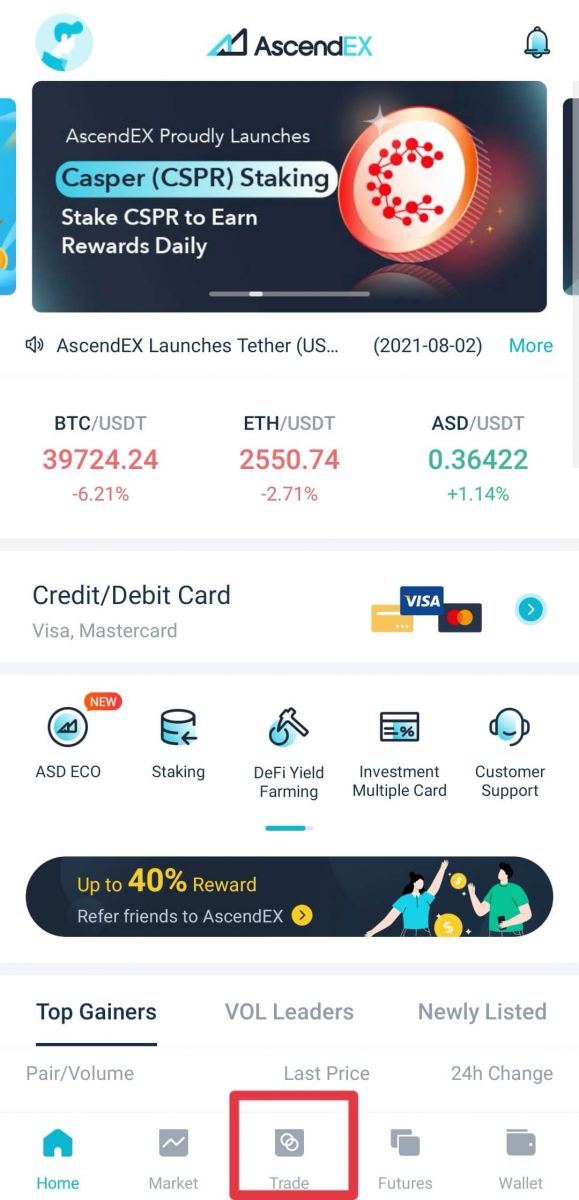

How to Check for Order History and Other Transfer History【APP】

Check the Order HistoryTo check the cash/margin order history, users should take the following steps:

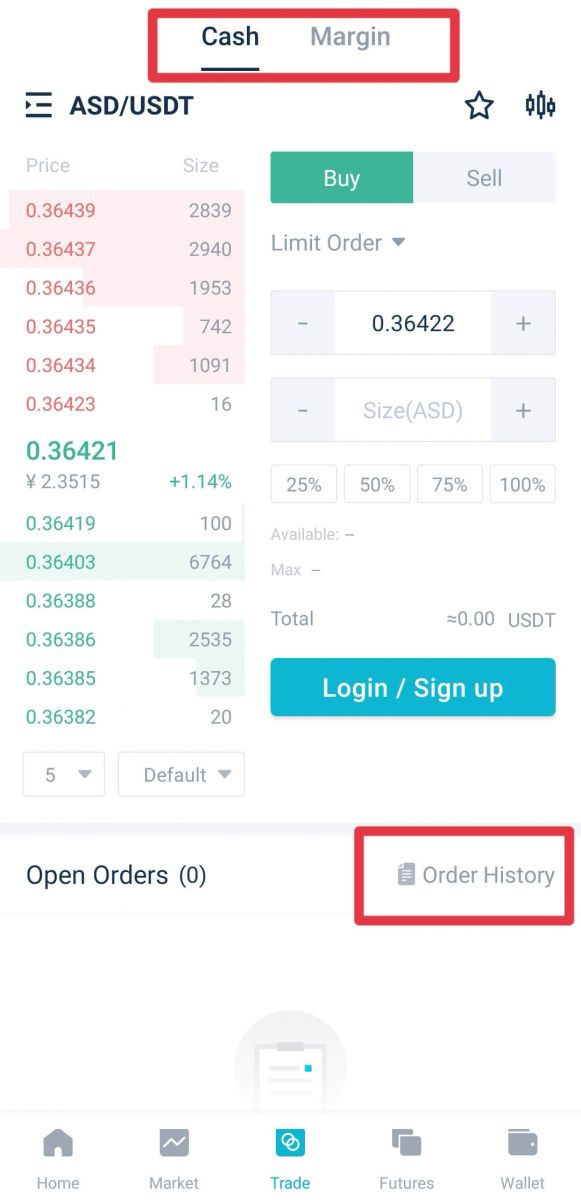

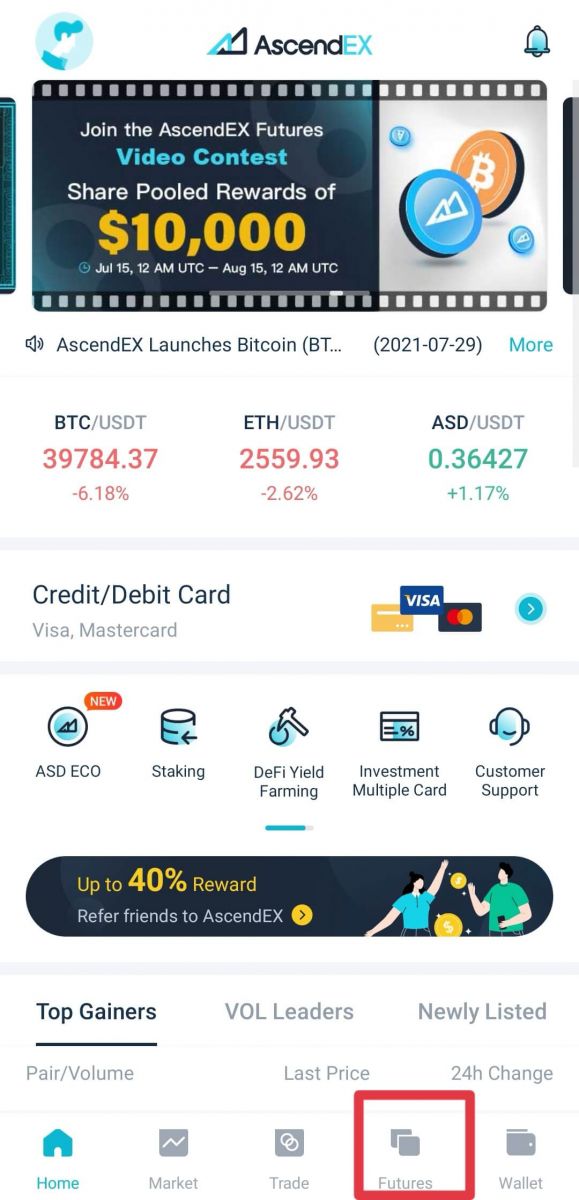

1. Open the AscendEX app and click [Trade] on the homepage.

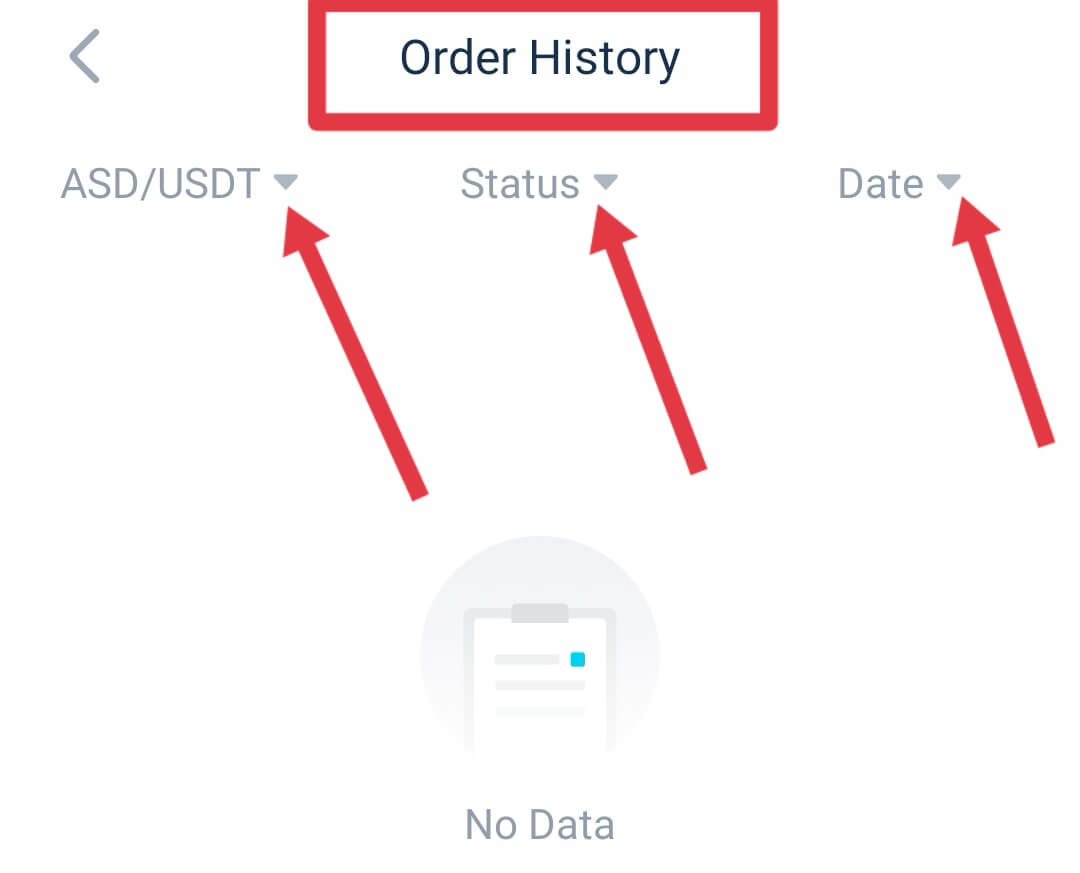

2. Click [Cash] or [Margin] on the top of the trading page and then click [Order History] on the bottom right of the page.

3. On the Order History page, users can check for the following information: trading pair, order status and date. For margin orders, users can also check for the liquidation history here.

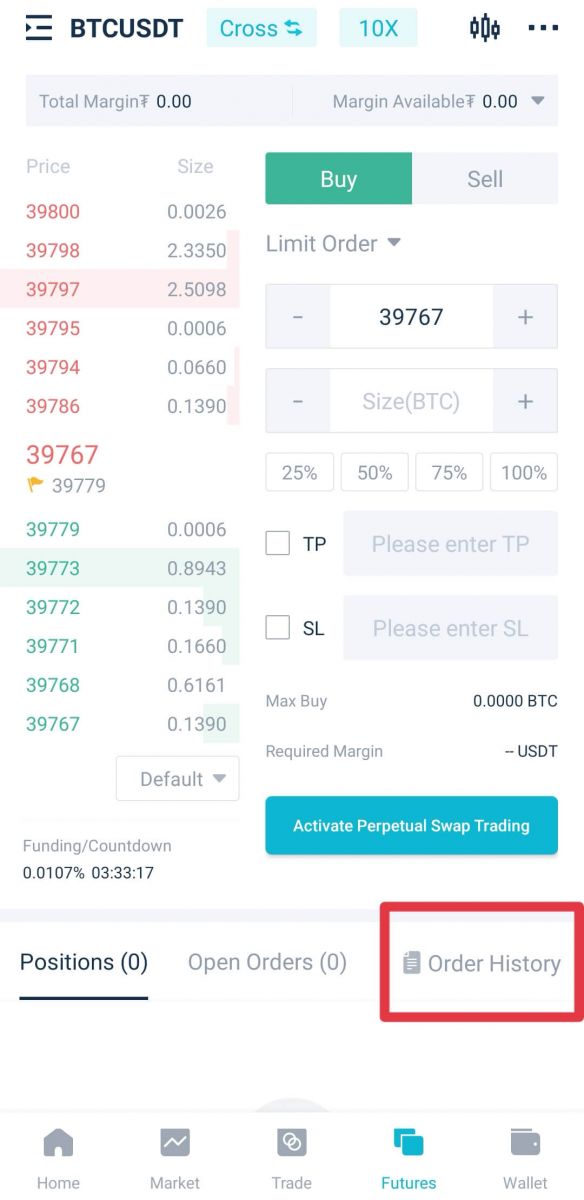

To check the order history for futures trades, users should take the following steps:

1. Click [Futures] on the homepage.

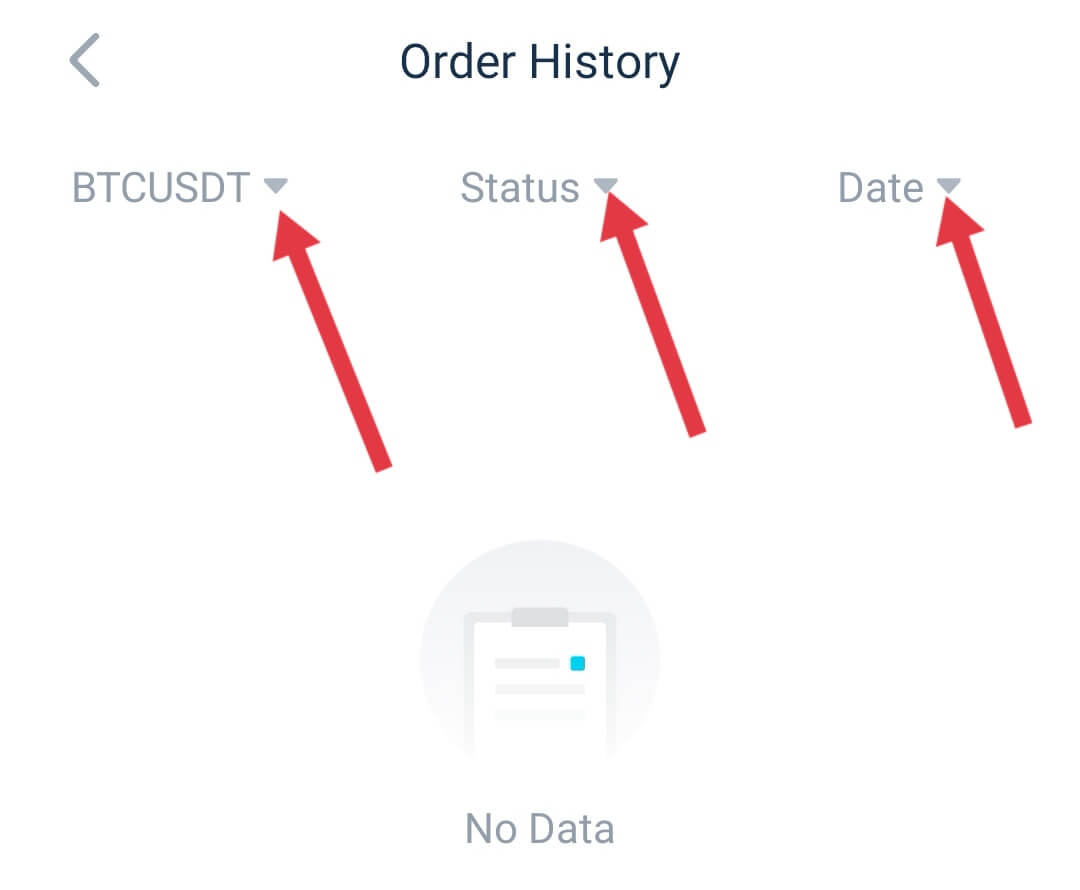

2. Click [Order History] on the bottom right of the trading page.

3. On the Order History page, users can check for the following information: trading pair, order status and date.

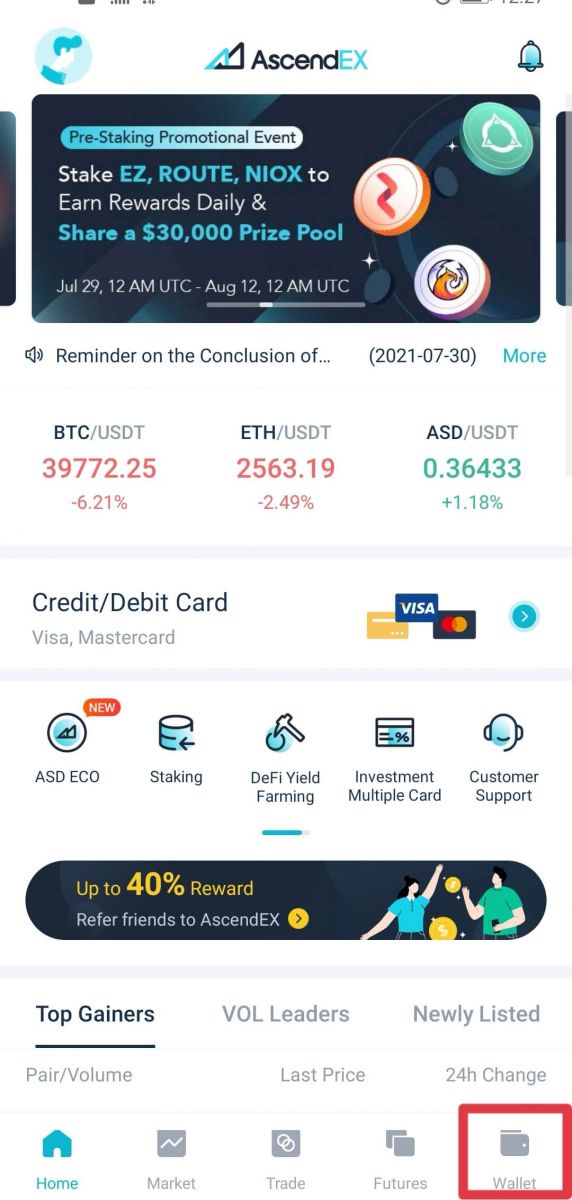

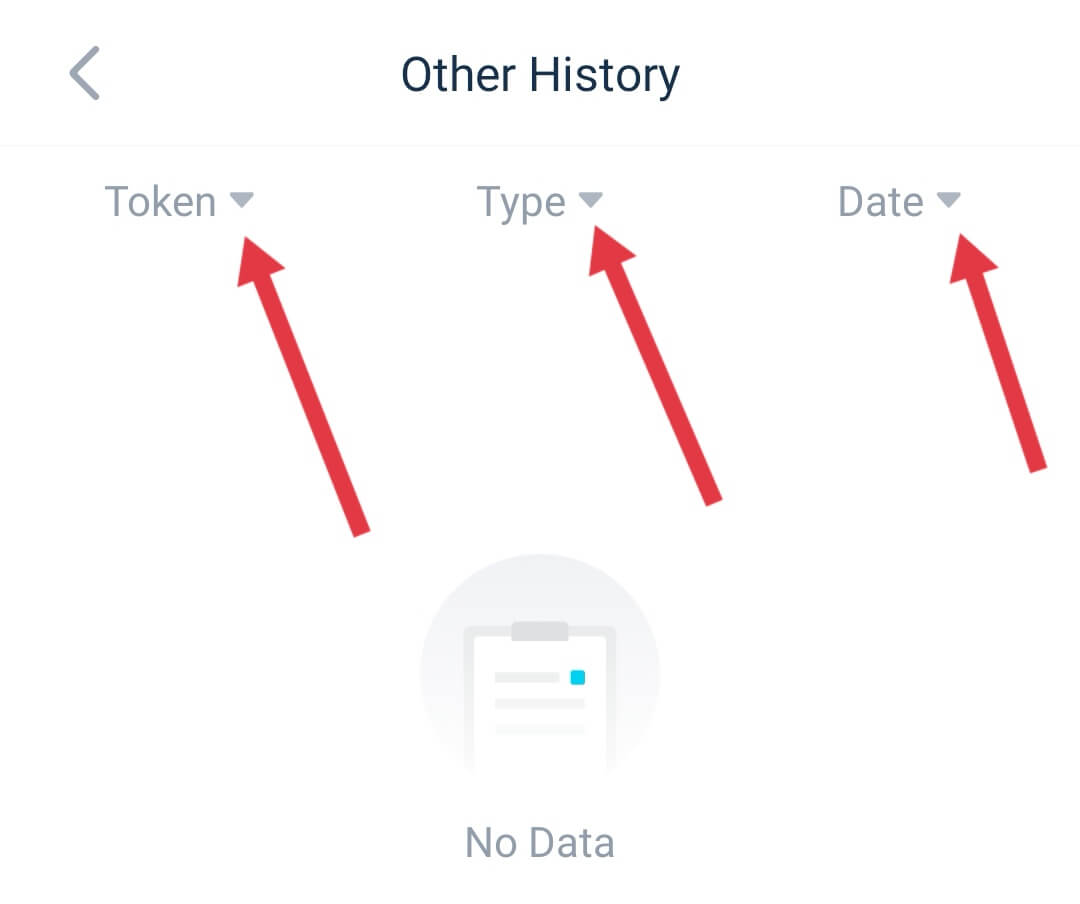

Check the Other Transfer History

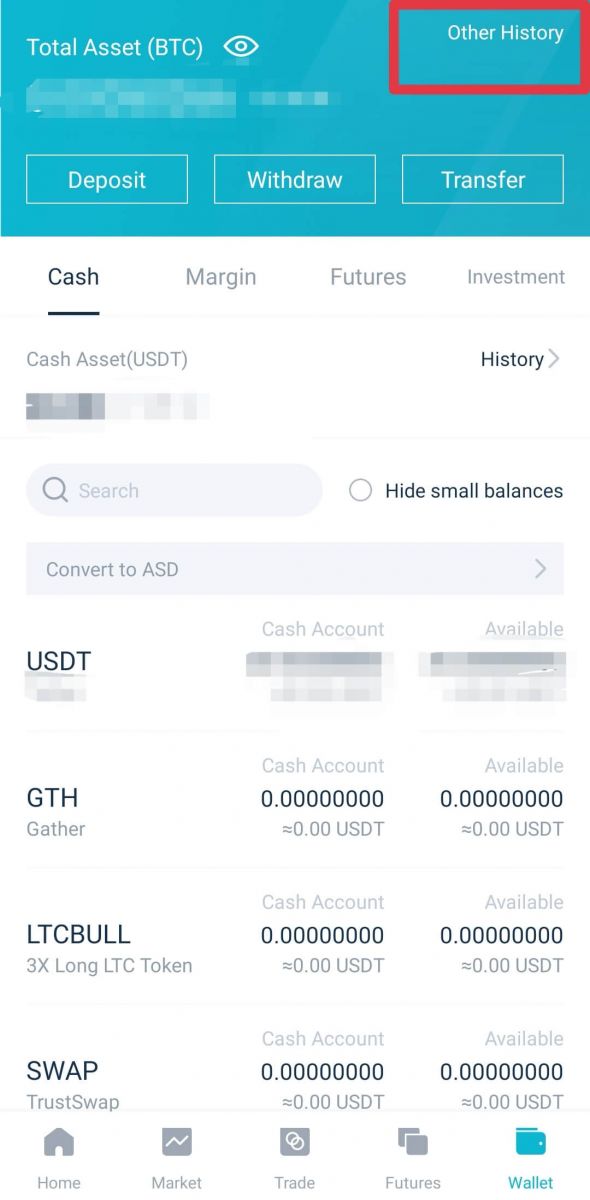

1. Click [Wallet] on the homepage of the AscendEX app.

2. Click [Other History] on the Wallet page.

3. Users can check for the following information about other transfer history: tokens, transfer types and date.

FAQ

What is a Limit/Market Order

Limit OrderA limit order is an order to buy or sell at a specific price or better. It is entered with both order size and order price.

Market Order

A Market order is an order to buy or sell immediately at the best available price. It is entered with order size only.

The market order will be placed as limit order on the book with 10% price collar. That means the market order (whole or partial) will be executed if the real-time quote is within the 10% deviation from the market price when the order is placed. The unfilled portion of market order will be canceled.

Limit Price Restriction

1. Limit OrderFor a sell limit order, the order will be rejected if the limit price is higher than twice or lower than half of the best bid price.

For a buy limit order, the order will be rejected if the limit price is higher than twice or lower than

half of the best ask price.

For Example:

Assuming that the current best bid price of BTC is 20,000 USDT, for a sell limit order, the order price cannot be higher than 40,000 USDT or lower than 10,000 USDT. Otherwise, the order will be rejected.

2. Stop-Limit Order

A. For a buy stop limit order, the following requirements must be met:

a. Stop price ≥current market price

b. The limit price cannot be higher than twice or lower than half of the stop price.

Otherwise, the order will be rejected

B. For a sell stop limit order, the following requirements met be met:

a. Stop price ≤current market price

b. The limit price cannot be higher than twice or lower than half of the stop price.

Otherwise, the order will be rejected

Example 1:

Assuming that the current market price of BTC is 20,000 USD, for a buy stop-limit order, the stop price must be higher than 20,000 USDT. If the stop price is set to be 30,0000 USDT, then the limit price cannot be higher than 60,000 USDT or lower than 15,000 USDT.

Example 2:

Assuming that the current market price of BTC is 20,000 USDT, for a sell stop-limit order, the stop price must be lower than 20,000 USDT. If the stop price is set to be 10,0000 USDT, then the limit price cannot be higher than 20,000 USDT or lower than 5,000 USDT.

Note: Existing orders on the order books are not subject to the above restriction update and will not be canceled due to market price movement.

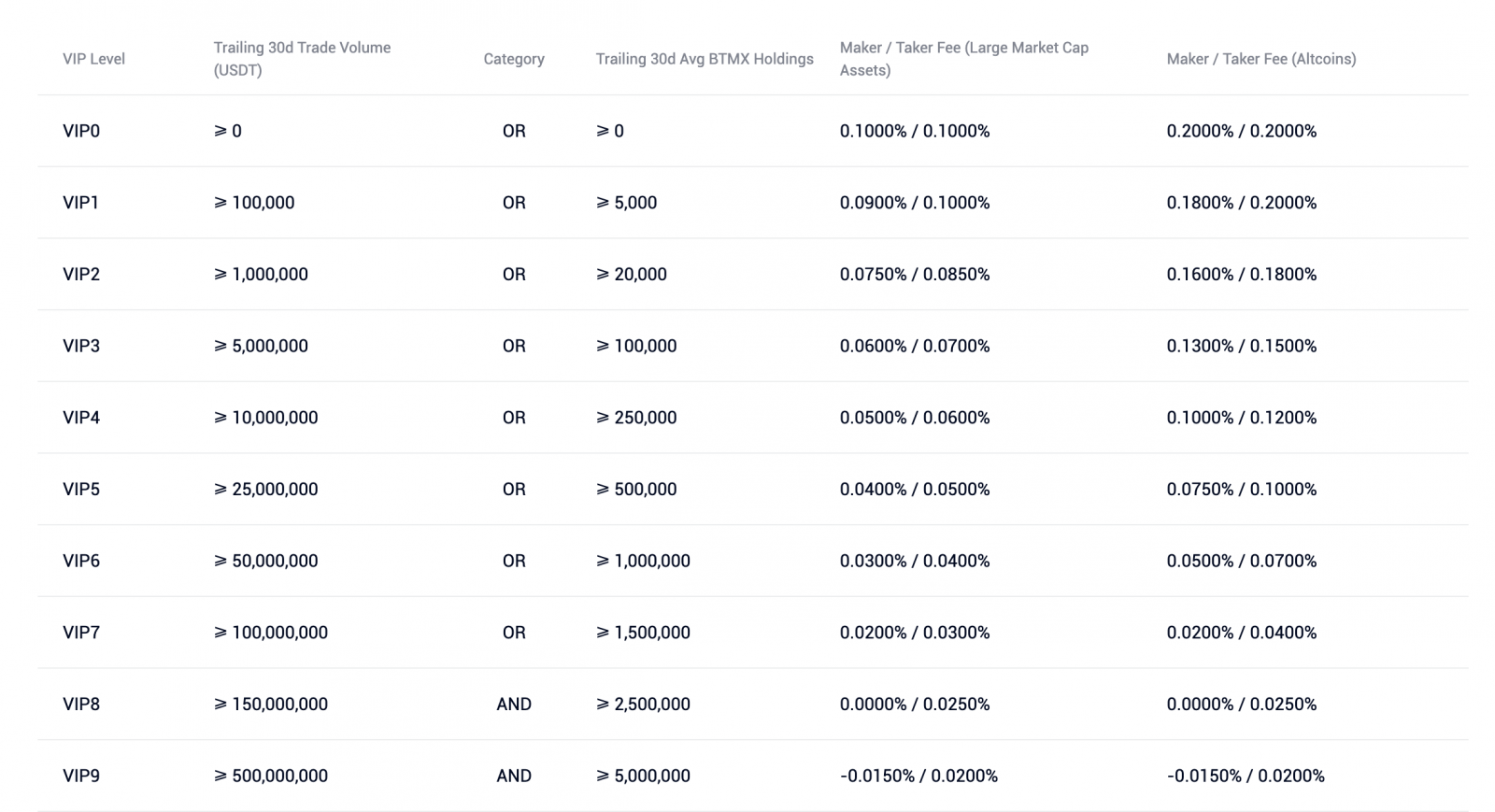

How to Get Fee Discounts

AscendEX has launched a new tiered VIP fee rebate structure. VIP tiers will have discounts set against base trading fees and are based on (i) trailing 30-day trade volume (across both asset classes) and (ii) trailing 30-day average unlock ASD holdings.

VIP tiers 0 through 7 will receive trading fee discounts based on trade volume OR ASD holdings. This structure will provide benefits of discounted rates across both high-volume traders that choose not to hold ASD, as well as ASD holders that might not trade enough to achieve favorable fee thresholds.

Top VIP tiers 8 through 10 will be eligible for the most favorable trading fee discounts and rebates based on trade volume AND ASD holdings. Top VIP tiers are therefore accessible only to clients that provide significant value-add to the AscendEX ecosystem as both high-volume traders AND ASD holders.

Note:

1. User’s trailing 30-day trade volume (in USDT) will be calculated every day at UTC 0:00 based on the daily average price of each trading pair in USDT.

2. User’s trailing 30-day average unlock ASD holdings will be calculated every day at UTC 0:00 based on the user’s average holding period.

3. Large Market Cap Assets: BTC, BNB, BCH, DASH, HT, ETH, ETC, EOS, LTC, TRX, XRP, OKB, NEO, ADA, LINK.

4. Altcoins: all other tokens/coins except Large Market Cap Assets.

5. Both Cash trading and Margin trading will be eligible for the new VIP fee rebate structure.

6. User’s unlock ASD holdings = Total Unlocked ASD in Cash Margin accounts.

Application Process: eligible users can send email to [email protected] with “request for VIP fee discount” as the subject line from their registered email on AscendEX. Also please attach screenshots of VIP levels and trading volume on other platforms.

Cash Trading

When it comes to digital assets, cash trading is one of the most basic types of trading and investment mechanism for any typical trader. We will walk through the basics of cash trading and review some of the key terms to know when engaging in cash trading.Cash trading involves purchasing an asset such as Bitcoin and holding it until its value increases or using it to buy other altcoins that traders believe may rise in value. In the Bitcoin spot market, traders buy and sell Bitcoin and their trades are settled instantly. In simple terms, it is the underlying market where bitcoins are exchanged.

Key Terms:

Trading pair: A trading pair consists of two assets where traders can exchange one asset for the other and vice versa. An example is the BTC/USD trading pair. The first asset listed is called the base currency, while the second asset is called the quote currency.

Order Book: An order book is where traders can view the current bids and offers that are available to buy or sell an asset. In the digital asset market, order books are updated constantly. This means that investors can execute a trade on an order book at any time.

Bid Price: The bid prices are orders that are looking to buy the base currency. When evaluating the BTC/USDtrading pair, since Bitcoin is the base currency, that means bid prices will be the offers to buy Bitcoin.

Ask Price: The asking prices are orders that are looking to sell the base currency. Therefore, when someone is trying to sell Bitcoin on the BTC/USD trading pair, the sell offers are referred to as asking prices.

Spread: The market spread is the gap between the highest bid offer and the lowest ask offer on the order book. The gap is essentially the difference between the price at which people are willing to sell an asset and the price that other people are willing to buy an asset.

Cash trading markets are relatively simple to engage with and trade on AscendEX. Users can get started HERE.