Frequently Asked Questions (FAQ) of Trading in AscendEX

Trading

What is a Limit/Market Order

Limit Order

A limit order is an order to buy or sell at a specific price or better. It is entered with both order size and order price.

Market Order

A Market order is an order to buy or sell immediately at the best available price. It is entered with order size only.

The market order will be placed as limit order on the book with 10% price collar. That means the market order (whole or partial) will be executed if the real-time quote is within the 10% deviation from the market price when the order is placed. The unfilled portion of market order will be canceled.

Limit Price Restriction

1. Limit Order

For a sell limit order, the order will be rejected if the limit price is higher than twice or lower than half of the best bid price.

For a buy limit order, the order will be rejected if the limit price is higher than twice or lower than

half of the best ask price.

For Example:

Assuming that the current best bid price of BTC is 20,000 USDT, for a sell limit order, the order price cannot be higher than 40,000 USDT or lower than 10,000 USDT. Otherwise, the order will be rejected.

2. Stop-Limit Order

A. For a buy stop limit order, the following requirements must be met:

a. Stop price ≥current market price

b. The limit price cannot be higher than twice or lower than half of the stop price.

Otherwise, the order will be rejected

B. For a sell stop limit order, the following requirements met be met:

a. Stop price ≤current market price

b. The limit price cannot be higher than twice or lower than half of the stop price.

Otherwise, the order will be rejected

Example 1:

Assuming that the current market price of BTC is 20,000 USD, for a buy stop-limit order, the stop price must be higher than 20,000 USDT. If the stop price is set to be 30,0000 USDT, then the limit price cannot be higher than 60,000 USDT or lower than 15,000 USDT.

Example 2:

Assuming that the current market price of BTC is 20,000 USDT, for a sell stop-limit order, the stop price must be lower than 20,000 USDT. If the stop price is set to be 10,0000 USDT, then the limit price cannot be higher than 20,000 USDT or lower than 5,000 USDT.

Note: Existing orders on the order books are not subject to the above restriction update and will not be canceled due to market price movement.

How to Get Fee Discounts

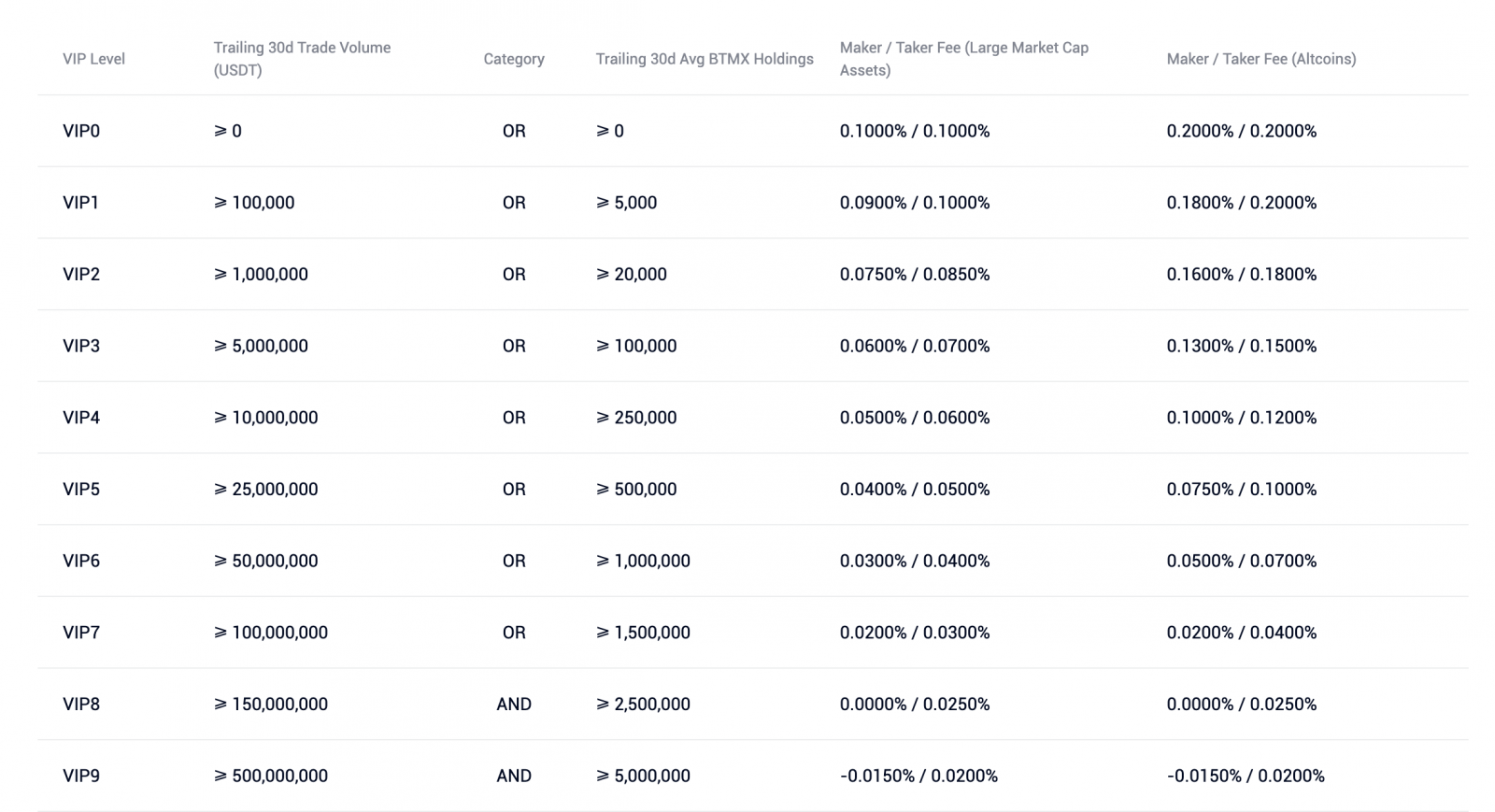

AscendEX has launched a new tiered VIP fee rebate structure. VIP tiers will have discounts set against base trading fees and are based on (i) trailing 30-day trade volume (across both asset classes) and (ii) trailing 30-day average unlock ASD holdings.

VIP tiers 0 through 7 will receive trading fee discounts based on trade volume OR ASD holdings. This structure will provide benefits of discounted rates across both high-volume traders that choose not to hold ASD, as well as ASD holders that might not trade enough to achieve favorable fee thresholds.

Top VIP tiers 8 through 10 will be eligible for the most favorable trading fee discounts and rebates based on trade volume AND ASD holdings. Top VIP tiers are therefore accessible only to clients that provide significant value-add to the AscendEX ecosystem as both high-volume traders AND ASD holders.

Note:

1. User’s trailing 30-day trade volume (in USDT) will be calculated every day at UTC 0:00 based on the daily average price of each trading pair in USDT.

2. User’s trailing 30-day average unlock ASD holdings will be calculated every day at UTC 0:00 based on the user’s average holding period.

3. Large Market Cap Assets: BTC, BNB, BCH, DASH, HT, ETH, ETC, EOS, LTC, TRX, XRP, OKB, NEO, ADA, LINK.

4. Altcoins: all other tokens/coins except Large Market Cap Assets.

5. Both Cash trading and Margin trading will be eligible for the new VIP fee rebate structure.

6. User’s unlock ASD holdings = Total Unlocked ASD in Cash Margin accounts.

Application Process: eligible users can send email to [email protected] with “request for VIP fee discount” as the subject line from their registered email on AscendEX. Also please attach screenshots of VIP levels and trading volume on other platforms.

Cash Trading

When it comes to digital assets, cash trading is one of the most basic types of trading and investment mechanism for any typical trader. We will walk through the basics of cash trading and review some of the key terms to know when engaging in cash trading.Cash trading involves purchasing an asset such as Bitcoin and holding it until its value increases or using it to buy other altcoins that traders believe may rise in value. In the Bitcoin spot market, traders buy and sell Bitcoin and their trades are settled instantly. In simple terms, it is the underlying market where bitcoins are exchanged.

Key Terms:

Trading pair: A trading pair consists of two assets where traders can exchange one asset for the other and vice versa. An example is the BTC/USD trading pair. The first asset listed is called the base currency, while the second asset is called the quote currency.

Order Book: An order book is where traders can view the current bids and offers that are available to buy or sell an asset. In the digital asset market, order books are updated constantly. This means that investors can execute a trade on an order book at any time.

Margin Trading

ASD Margin Trading Rules

- ASD margin loan interest is calculated and updated on user’s account every hour, different from other margin loans’ settlement cycle.

- For the ASD available in the Margin Account, users can subscribe to ASD Investment Product on the user’s My Asset - ASD page. Daily return distribution will be posted to the user’s Margin Account.

- ASD Investment quota in Cash Account can be transferred to Margin Account directly. ASD Investment quota in the Margin Account can be used as collateral.

- 2.5% haircut will be applied for ASD Investment quota when used as collateral for margin trading. When ASD investment quota causes the Net Asset of Margin Account lower than Effective Minimum Margin, the system will reject the product subscription request.

- Forced liquidation priority: ASD Available prior to ASD Investment quota. When a margin call is triggered, forced liquidation of ASD investment quota will be executed and 2.5% commission fee will be applied.

- Reference Price of ASD forced liquidation= Average of ASD mid-price over the last 15 minutes. Mid-price = (Best Bid + Best Ask)/2

- Users are not allowed to short ASD if there is any ASD Investment quota in either Cash Account or Margin Account.

- Once there is ASD available from investment redemption in user’s account, the user can short ASD.

- Daily return distribution of ASD Investment Product will be posted to Margin Account. It will serve as repayment for any USDT loan at that time.

- ASD interests paid by borrowing ASD will be deemed as consumption.

AscendEX Point Card Rules

AscendEX launched the Point Card in support of a 50% discount for the repayment of users’ margin interest.How to Purchase Point Cards

1. Users can purchase Point Cards on the margin trading page (Left Corner) or go to My Asset-Buy Point Card for purchase.

2. The Point Card is sold at the value of 5 USDT equivalent of ASD each. Card price is updated every 5 minutes based on the previous 1-hour average ASD price. Purchase is completed after clicking the “Buy Now” button.

3. Once ASD tokens are consumed, they will be transferred to a specific address for permanent lock-up.

How to Use Point Cards

1. Each Point Card is worth 5 points with 1 point redeemable for 1 UDST. Point’s decimal accuracy is consistent with USDT trading pair’s price.

2. Interest will always be paid with Point Cards first if available.

3. Interest incurred post purchase gets a 50% discount when paid with Point Cards. However, such discount is not applicable to existing interest.

4. Once sold, point Cards are non-refundable.

What is the Reference Price

In order to mitigate price deviation due to market volatility, AscendEX uses composite reference price for the calculation of margin requirement and forced liquidation. The reference price is computed by taking an average last trade price from the following five exchanges - AscendEX, Binance, Huobi, OKEx and Poloniex, and removing the highest and the lowest price.AscendEX reserves the right of updating pricing sources without notice.

AscendEX Margin Trading Rules

AscendEX Margin Trading is a financial derivative instrument used for cash trading. While using the Margin Trading mode, AscendEX users can leverage their tradable asset to achieve a potential higher return on their investment. However, users must also understand and bear the risk of potential losses of Margin Trading.Margin trading on AscendEX requires collateral to support its leverage mechanism, allowing users to borrow and repay at any point while margin trading. Users do not need to manually request to borrow or return. When users transfer their BTC, ETH, USDT, XRP, etc. assets to their “Margin Account”, all account balances can be used as collateral.

1.What is Margin Trading?

Trading on margin is the process by which users borrow funds to trade more digital assets than what they would normally be able to afford. Margin trading allows users to increase their buying power and potentially achieve a higher return. However, considering the digital asset’s high market volatility nature, users may also incur much greater losses with the use of leverage. Therefore, users should fully understand the risk of trading on margin before opening a margin account.

2.Margin Account

AscendEX margin trading requires a separate “Margin Account.”Users can transfer their assets from their Cash Account to their Margin Account as collateral for margin loan under the [My Asset] page.

3.Margin Loan

Upon successful transfer, the platform’s system will automatically apply the maximum leverage available based on the user’s “Margin Asset” balance. Users do not need to request a margin loan.

When the margin trading position exceeds the Margin Assets, the exceeding portion will represent the margin loan. The user’s margin trading position must stay within the specified Maximum Trading Power (limit).

For example:

A user’s order will be rejected when the total loan exceeds the account’s Maximum Borrowable Limit. The error code is displayed under Open Order/Order History section on trading page as ‘Not Enough Borrowable’. As a result, users will not be able to borrow more until they repay and reduce the outstanding loan under the Maximum Borrowable Limit.

4.Interests of Margin Loan

Users can only repay their loan with the token they borrowed. Interest on margin loans are calculated and updated on users’ accounts page every 8 hours at 8:00 UTC, 16:00 UTC and 24:00 UTC. Please note that any holding period less than 8 hours will be counted as an 8-hour period. No interest will be taken into account when borrowing and repaying actions are completed before the next margin loan gets updated.

Point Card Rules

5.Loan Repayment

AscendEX allows users to repay the loans by either transacting the assets from their Margin Account or transferring more assets from their Cash Account. Maximum trading power will be updated upon repayment.

Example:

When the user transfers 1 BTC to the Margin Account and the current leverage is 25 times, the Maximum Trading Power is 25 BTC.

Assuming at the price of 1 BTC = 10,000 USDT, buying additional 24 BTC with selling 240,000 USDT results in the loan (Borrowed Asset) of 240,000 USDT. The user can repay the loan plus interests by either making transfer from Cash Account or selling BTC.

Make a Transfer:

Users can transfer 240,000 USDT (plus interest incurred) from the Cash Account to repay the loan. Maximum trading power will increase accordingly.

Make a Transaction:

Users can sell 24 BTC (plus respective interest owed) through margin trading and the sales proceeds will automatically be deducted as loan repayment against borrowed assets. Maximum trading power will increase accordingly.

Note: Interest portion will be repaid prior to the loan’s principle.

6. Computation of Margin Requirement and Liquidation

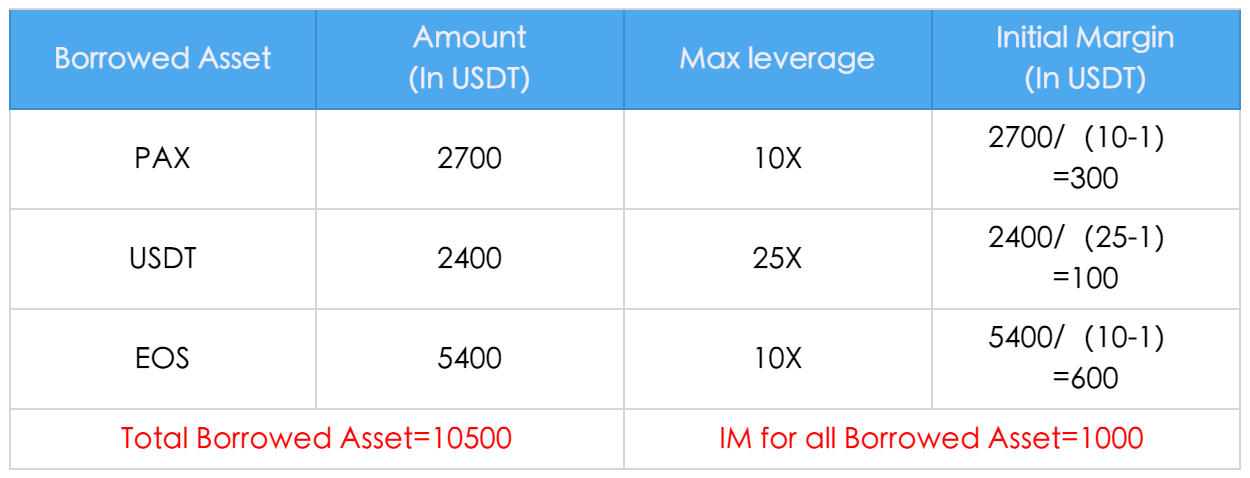

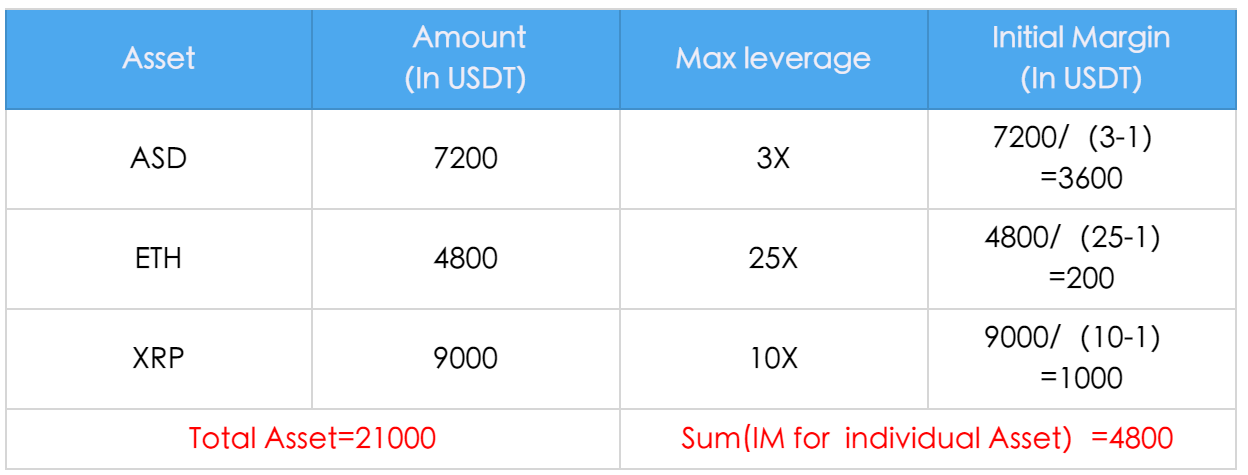

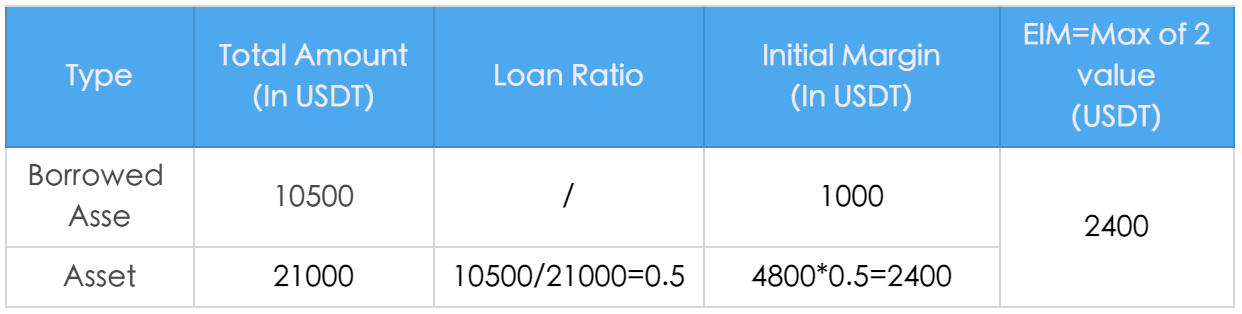

In the Margin Trading, Initial Margin (“IM”) will be calculated first separately for user’s Borrowed Asset, user’s Asset and overall user accounts. Then the highest value of all will be used for the Effective Initial Margin (EIM) for the account. IM is converted to USDT value based on the current market price available.

EIM for the account= Maximum Value of (IM for all Borrowed Asset, IM for Total Asset, IM for the account)

IM for individual Borrowed Asset = (Borrowed Asset + Interest Owed)/ (Max Leverage for the Asset-1)

IM for all Borrowed Asset = Summation of (IM for individual Borrowed Asset)

IM for individual Asset = Asset / (Max Leverage for the Asset -1)

IM for Total Asset = Summation of all the (IM for individual Asset) * Loan Ratio

Loan Ratio = (Total Borrowed Asset + Total Interest Owed) / Total Asset

IM for the account = (Total Borrowed Asset + Total Interest Owed) / (Maximum Leverage for the account -1)

Example:

User’s position is shown as below:

Therefore, Effective Initial Margin for the account is calculated as follows:

Note:

For the purpose of illustration, Interest Owed is set at 0 in the example above.

When the current Net Asset of Margin Account is lower than the EIM, users cannot borrow more funds.

When the current Net Asset of Margin Account exceeds the EIM, users can place new orders. However, the system will calculate the impact of new order on the Net Asset of Margin Account based upon the order price. If the newly placed order will cause the new Net Asset of Margin Account to drop below the new EIM, the new order will be rejected.

Update of Effective Minimum Margin (EMM) for the account

Minimum Margin (MM) will first be calculated for user’s Borrowed Assets and Assets. The greater value of those two will be used for the Effective Minimum Margin for the account. MM is converted to USDT value based off the market price available.

EMM for the account = Maximum value of (MM for all Borrowed Asset, MM for Total Asset)

MM for individual Borrowed Asset = (Borrowed Asset + Interest Owed)/ (Max Leverage for the Asset*2 -1)

MM for all Borrowed Asset = Summation of (MM for individual Borrowed Asset)

MM for individual Asset = Asset / (Max Leverage for the Asset *2 -1)

MM for Total Asset = Summation of (MM for individual Asset) * Loan Ratio

Loan Ratio = (Total Borrowed Asset + Total Interest Owed) / Total Asset

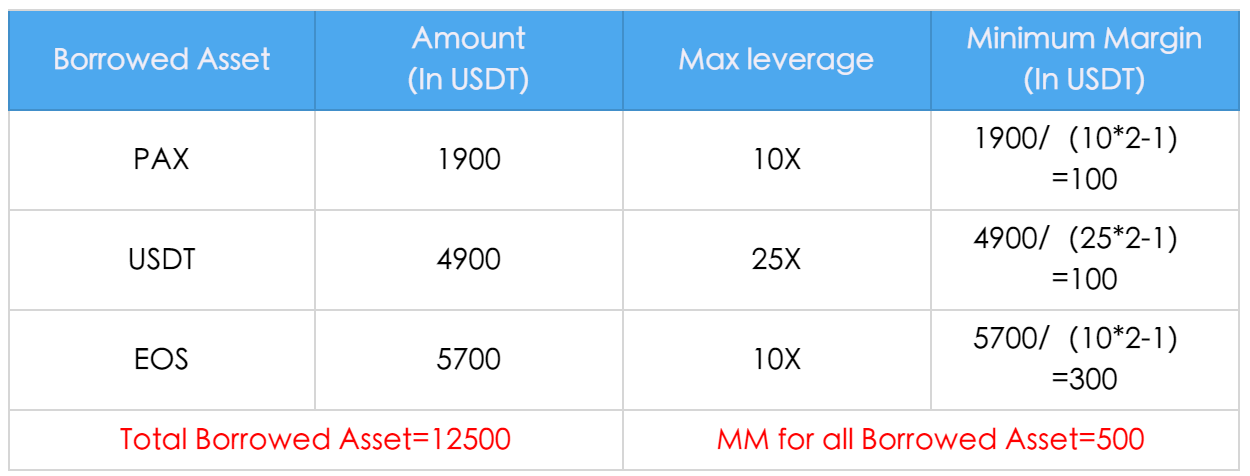

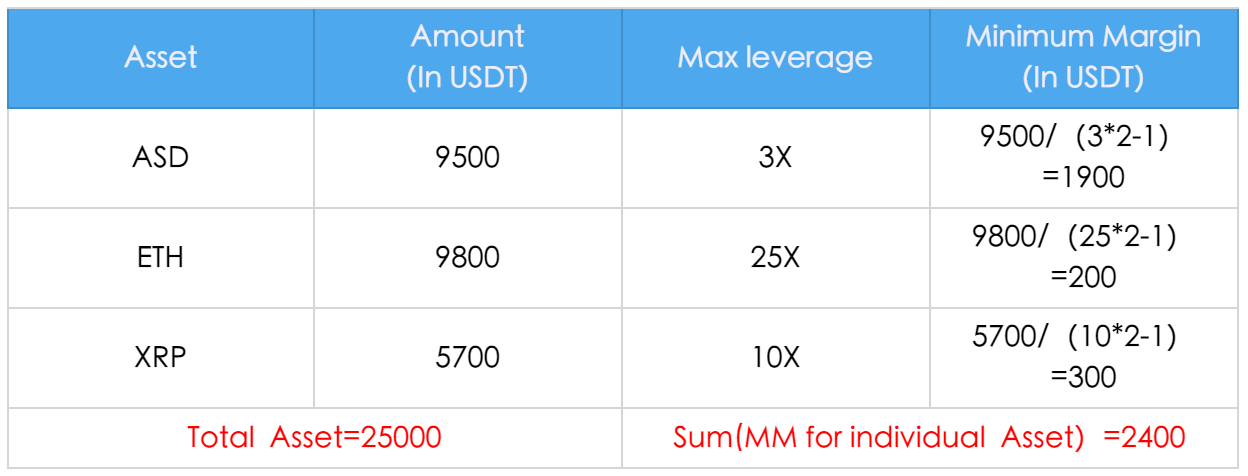

An example of the user’s position is shown below:

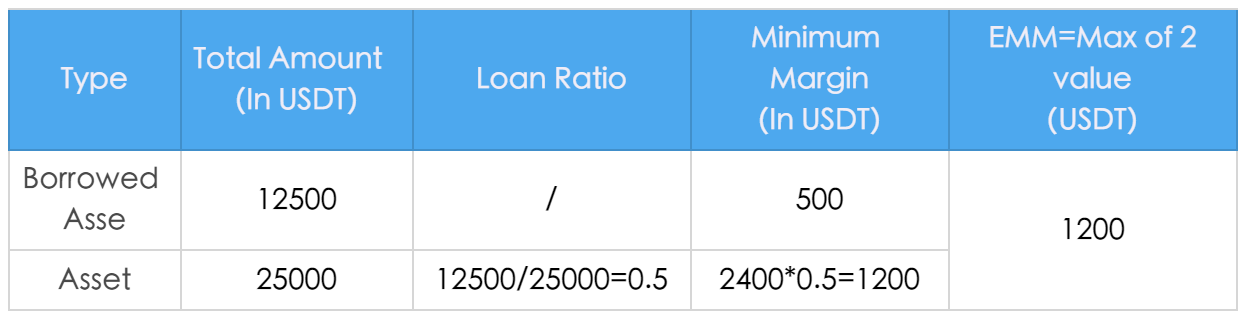

Therefore, Effective Minimum Margin for the account is calculated as follows:

Rules for Open Orders

Open order of margin trading will lead to the increase of Borrowed Asset even before the order execution. However, it will not affect the Net Asset.

Note:

For the purpose of illustration, Interest Owed is set as 0 in the example above.

Rules for Liquidation Process remain the same. When cushion rate reaches 100%, the user’s margin account will be subject to forced liquidation immediately.

Cushion rate = Net Asset of Margin Account / Effective Minimum Margin for the account.

The Calculation of Total Amount of Borrowed Assets and Assets

Under the Loan Summary section on the margin trading page, Balance and Loan Amount are displayed by asset.

Total Amount of Asset = Sum of Balance of all assets converted to the equivalent value of USDT based off the market price

Total Amount of Borrowed Asset = Sum of Loan Amount for all assets converted to the equivalent value of USDT based off the market price.

Current Margin Ratio = Total Asset / Net Asset (which is Total Asset – Borrowed Asset – Interest Owed)

Cushion = Net Asset/Min Margin Req.

Margin Call: When cushion reaches 120%, the user will receive a margin call via email.

Liquidation: When cushion reaches 100%, the user’s margin account may be subject to liquidation.

7.Liquidation Process

Reference Price

In order to mitigate price deviation due to market volatility, AscendEX uses composite reference price for the calculation of margin requirement and forced liquidation. The reference price is computed by taking an average last trade price from the following five exchanges (upon availability at the time of computation)- AscendEX, Binance, Huobi, OKEx and Poloniex, and removing the highest and lowest price.

AscendEX reserves the right of updating pricing sources without notice.

Process Overview

- When the cushion of the margin account reaches 1.0, forced liquidation will be executed by the system, namely the forced liquidation position will be executed in the secondary market;

- If the cushion of the margin account reaches 0.7 during forced liquidation or the cushion is still below 1.0 after the forced liquidation position is executed, the position will be sold to the BLP;

- All functions will be automatically resumed for the margin account after the position is sold to the BLP and executed, namely the balance of the account is not negative.

8.Fund transfer

When a users Net Assets are greater than 1.5 times that of the Initial Margin, the user can transfer assets from their Margin Account to their Cash Account as long as the Net Asset remains higher or equal to 1.5 times of the Initial Margin.

9.Risk Reminder

While margin trading can boost buying power for a higher profit potential with the use of financial leverage, it can also amplify the trading loss if the price moves against the user. Therefore, user should limit the usage of high margin trading in order to mitigate risk of liquidation and even greater financial loss.

10.Case Scenarios

How to trade on margin when the price goes up? Here is an example of BTC/USDT with 3x leverage.

If you expect that BTC price would go up from 10,000 USDT to 20,000 USDT, you can borrow maximum of 20,000 USDT from AscendEX with 10,000 USDT capital. At the price of 1 BTC = 10,000 USDT, you can buy 25 BTC and then sell them when the price doubles. In this case, your profit would be:

25*20,000 – 10,000 (Capital Margin) – 240,000 (Loan) = 250,000 USDT

Without the margin, you would only have realized PL gain of 10,000 USDT. In comparison, margin trading with 25x leverage amplifies the profit by 25 times.

How to trade on margin when the price drops? Here is an example of BTC/USDT with 3x leverage:

If you expect that BTC price would drop from 20,000 USDT to 10,000 USDT, you can borrow maximum of 24 BTC from AscendEX with 1BTC capital. At the price of 1 BTC = 20,000 USDT, you can sell 25 BTC and then buy them back when the price drops by 50%. In this case, your profit would be:

25*20,000 – 25*10,000= 250,000 USDT

Without the ability to trade on margin, you would not able to short the token in anticipation of falling price.

Leveraged Tokens

What are Leveraged Tokens?

Each leveraged token token owns a position in futures contracts. The price of the token will tend to track the price of the underlying positions it holds.Our BULL tokens approximates 3x returns, and BEAR tokens approximate -3x returns.

How do I buy and sell them?

You can trade the leveraged tokens on FTX spot markets. Go to the token page and click on trade for the token you want.You can also go to your wallet and click CONVERT. There is no fee on this, but the price will depend on market conditions.

How do I deposit and withdraw the tokens?

The tokens are ERC20 tokens. You can deposit and withdraw them from the wallet page to any ETH wallet.Rebalances and Returns

Leveraged tokens rebalance once per day and whenever they get 4x levered.Because of the daily rebalancing, leveraged tokens will reduce risk when they lose and reinvest profits when they win.

Thus, each day a +3x BULL token will move about 3 times as much as the underlying. Because of the rebalances, leveraged tokens will outperform the underlying over longer time periods if markets exhibit momentum (i.e. consecutive days have positive correlation), and underperform if markets exhibit mean reversion (i.e. consecutive days have negative correlation).

As an example, comparing BULL to 3x long BTC:

| BTC daily prices | BTC | 3x BTC | BTCBULL |

| 10k, 11k, 10k | 0% | 0% | -5.45% |

| 10k, 11k, 12.1k | 21%% | 63% | 69% |

| 10k, 9.5k, 9k | -10% | -30% | -28.4% |

How do I create and redeem them?

You can use USD to create any of the tokens, and you can redeem any of the tokens back for USD.The redemptions are cash--instead of delivering the underlying futures positions, you receive USD equal to their market value. Similarly you send USD equal to the market value of the positions the token owns to create rather than delivering futures positions themselves.

To create or redeem them, go to the leveraged token dashboard and click on the token you want to create/redeem.

What are their fees?

It costs 0.10% to create or redeem a token. Tokens also charge a daily management fee of 0.03%.If you trade on the spot markets, instead youll pay the same exchange fees as on all other markets.

What tokens does this platform have?

It has leveraged tokens based on the futures listed on this platform. It currently lists -1, -3, and +3 leveraged tokens on everything we have a future on. For more information see here.Could it be possible for BULL/BEAR to be moving in the same direction?

Yes, it could be both positive or negative depends on market volatility. More information with regard to its pricing mechanism could be found here.

Why Use Leveraged Tokens?

There are three reasons to use leveraged tokens.Managing Risk

Leveraged tokens will automatically reinvest profits into the underlying asset; so if your leveraged token position makes money, the tokens will automatically put on 3x leveraged positions with that.

Conversely, leveraged tokens will automatically reduce risk if they lose money. If you put on a 3x long ETH position and over the course of a month ETH falls 33%, your position will be liquidated and you will have nothing left. But if you instead buy ETHBULL, the leveraged token will automatically sell off some of its ETH as markets go down--likely avoiding liquidation so that it still has assets left even after a 33% down move.

Managing Margin

You can buy leveraged tokens just like normal ERC20 tokens on a spot market. No need to manage collateral, margin, liquidation prices, or anything like that; you just spend $10,000 on ETHBULL and have a 3x leveraged long coin.

ERC20 Tokens

Leveraged tokens are ERC20 tokens. That means that--unlike margin positions--you can withdraw them from your account! You go to your wallet and send leveraged tokens to any ETH wallet. This means you can custody your own leveraged tokens; it also means you can send them to other platforms that list the leveraged tokens, like Gopax.

How Do Leveraged Tokens Work?

Each leveraged token gets its price action by trading FTX perpetual futures. For instance, say that you want to create $10,000 of ETHBULL. To do so you send in $10,000, and the ETHBULL account on FTX buys $30,000 worth of ETH perpetual futures. Thus, ETHBULL is now 3x long ETH.You can also redeem leveraged tokens for their net asset value. To do that, you can send your $10,000 of ETHBULL back to FTX, and redeem it. This will destroy the token; cause the ETHBULL account to sell back the $30,000 worth of futures; and credit your account with $10,000.

This creation and redemption mechanism is what ultimately enforces that the leveraged tokens are worth what theyre supposed to be.

How Do Leveraged Tokens Rebalance?

Every day at 00:02:00 UTC the leveraged tokens rebalance. That means that each leveraged token trades on FTX in order to once again reach its target leverage.For instance, say that the current holdings of ETHBULL are -$20,000 and + 150 ETH per token, and ETH is trading at $210. ETHBULL has a net asset value of (-$20,000 + 150*$210) = $11,500 per token, and an ETH exposure of 150*$210 = $31,500 per token. Thus its leverage is 2.74x, and so it needs to buy more ETH in order to return to 3x leverage, and will do so at 00:02:00 UTC.

Thus, every day each leverage token reinvests profits if it made money. If it lost money, it sells off some of its position, reducing its leverage back to 3x in order to avoid liquidation risk.

In addition, any token will rebalance if an intraday move causes its leverage to be 33% higher than its target. So if markets move down enough that BULL token is 4x leveraged it will rebalance. This corresponds to market moves of roughly 11.15% for BULL tokens, 6.7% for BEAR tokens, and 30% for HEDGE tokens.

This means that leveraged tokens can give up to 3x leverage without much risk of liquidation. It would require a 33% market move to liquidate a 3x leveraged token, but the token will generally rebalance within a 6-12% market move, reducing its risk and returning to 3x leveraged.

Specifically, the way rebalances happen is:

1. FTX periodically monitors for LT leverages. If any LT leverage goes above 4x in magnitude, it triggers a rebalance for that LT.

2. When a rebalance is triggered, FTX calculates the number of units of the underlying the LT needs to buy/sell to return to 3x leverage, marked to prices at that time.

This is the Formula:

2. When a rebalance is triggered, FTX calculates the number of units of the underlying the LT needs to buy/sell to return to 3x leverage, marked to prices at that time.

This is the Formula:

A. Desired position (DP): [Target Leverage] * NAV / [underlying mark price]

B. Current Position (CP): current holdings per token of the underlying

C. Rebalance size: (DP - CP) * [LT tokens outstanding]

B. Current Position (CP): current holdings per token of the underlying

C. Rebalance size: (DP - CP) * [LT tokens outstanding]

3. FTX then sends orders in the associated FTX perpetual futures orderbook to rebalance (e.g. ETH-PERP for ETHBULL/ETHBEAR). It sends a maximum of $4m of orders per 10 seconds until it has sent the desired total size. These are all normal, public IOCs that trade against the prevailing bids/offers in the order-book at the time.

4. Note that this ignores difference between the underlying price when a rebalance is triggered and when it happens; ignores fees; and may have rounding errors.

This means that leveraged tokens can give up to 3x leverage without much risk of liquidation. It would require a 33% market move to liquidate a 3x leveraged token, but the token will rebalance on a 10% market move, reducing its risk and returning to 3x leveraged.

What Are Leveraged Tokens Performance?

Daily Move

Each day, leveraged tokens will have their target performance; so for example, each day (from 00:02:00 UTC to 00:02:00 UTC the next day) ETHBULL will move 3x as much as ETH.

Multiple Days

However, over longer time periods leveraged tokens will perform differently than a static 3x position.

For instance, say that ETH starts at $200, then goes to $210 during day 1, and then to $220 during day 2. ETH increased 10% (220/200 - 1), so a 3x leveraged ETH position would have increased 30%. But ETHBULL instead increased 15% and then 14.3%. On day 1 ETHBULL increased the same 15%. Then it rebalanced, buying more ETH; and on day 2 it increased 14.3% of its new, higher price, whereas a 3x long position would have just increased another 15% of the original $200 ETH price. So during this 2-day stretch, the 3x position is up 15% + 15% = 30%, but ETHBULL is up 15% from the original price, plus 14.3% of the new price--so its actually up 31.4%.

This difference comes because the compounded increase on a new price is different from moving up 30% from the original price. If you move up twice, the second 14.3% move is on a new, higher price--and so its actually a 16.4% increase on the original, lower price. In order words, your gains compound with leveraged tokens.

Rebalance Times

Leveraged tokens performance will be 3x the underlying performance if youre measuring since the last rebalance time. In general leveraged tokens rebalance every day at 00:02:00 UTC. This means that the trailing 24h moves might not be exactly 3x the underlying performance, rather the moves since midnight UTC will be. In addition, leveraged tokens that are over leveraged rebalance whenever their leverage reaches 33% higher than its target. This happens, roughly, when the underlying asset moves 10% for BULL/BEAR tokens and 30% for HEDGE tokens. So in fact the leverage token performance will be 3x the underlying asset since the asset last moved 10% that day if there was a large move and the token lost to it, and since midnight UTC if there wasnt.

The Formula

If the movement of the underlying asset on days 1, 2, and 3 is M1, M2, and M3, then the formula for the price increase of the 3x leveraged token is:

New Price = Old Price * (1 + 3*M1) * (1 + 3*M2) * (1 + 3*M3)

Price movement in % = New Price / Old Price - 1 = (1 + 3*M1) * (1 + 3*M2) * (1 + 3*M3) - 1

When Do Leveraged Tokens Do Well?

Obviously the BULL tokens do well when prices go up, and the BEAR tokens do well when prices go down. But how do they compare to normal margin positions? When does BULL do better than a +3x leveraged position, and when does it do worse?Reinvesting Profits

Leveraged tokens reinvest their profits. That means that, if they have positive PnL, theyll increase their position size. So, comparing ETHBULL to a +3x ETH position: if ETH goes up one day and then up again the next, ETHBULL will do better than +3x ETH, because it reinvested the profits from the first day back into ETH. However, if ETH goes up and then falls back down, ETHBULL will do worse, because it increased its exposure.

Reducing Risk

Leveraged tokens reduce their risk if they have negative PnL to avoid liquidations. So, if they have negative PnL, theyll reduce their position size. Comparing ETHBULL to a +3x ETH position again: if ETH goes down one day and then down again the next, ETHBULL will do better than +3x ETH: after the first loss ETHBULL sold off some of its ETH to return to 3x leverage, while the +3x position effective became even more leveraged. However, if ETH goes down and then back up, ETHBULL will do worse: it reduced some of its ETH exposure after the first loss, and so took less advantage of the recovery.

Example

As an example, comparing ETHBULL to 3x long ETH:

| ETH daily prices | ETH | 3x ETH | ETHBULL |

| 200, 210, 220 | 10% | 30% | 31.4% |

| 200, 210, 200 | 0% | 0% | -1.4% |

| 200, 190, 180 | -10% | -30% | -28.4% |

Summary

In the above cases, leveraged tokens do well--or at least better than a margin position that starts out the same size--when markets have momentum. However they do worse than a margin position when markets mean-revert.

A common misconception is that leveraged tokens have exposure to volatility, or gamma. Leveraged tokens do well if markets move up a lot and then up a lot more, and poorly if markets move up a lot and then back down a lot, both of which are high volatility. The real exposure that they have is primarily to price direction, and secondarily to momentum.

Trade BULL/BEAR

BULL- BEAR

ETHBULL - ETHBEAR

How Do You Buy/Sell Leveraged Tokens?

There are multiple ways to do so.Spot markets (Recommended)

The easiest way to buy a leveraged token is on its spot market. For instance you can go to the ETHBULL/USD spot market and buy or sell back ETHBULL. You can find a leveraged tokens spot market by going to the tokens page and clicking on the name; or by clicking on the underlying future on the top bar and then on the name of the market.

Convert

You can also buy or sell leveraged tokens directly from your wallet page using the CONVERT function. If you find a token and click CONVERT on the right hand side of the screen, youll see a dialog box in which you can easily turn any of your coins on AscendEX into the leveraged token.

Creation/Redemption

Finally, you can create or redeem leveraged tokens. This is not recommended unless you have read through all of the documentation on leveraged tokens. Creating or redeeming leveraged tokens will have market impact and you wont know what price you ultimately get until after youve created or redeemed. We recommend using the spot markets instead.

You can create or redeem a leveraged token by going to the tokens page and clicking more info. If you create $10,000 of ETHBULL, this will send a market order to buy $30,000 of ETH-PERP, calculate the price paid, and then charge you that amount of money; itll then credit your account with the corresponding amount of ETHBULL.